First public company to adopt Sui as a treasury asset amid rising AI and DeFi momentum

Mill City Ventures III, a Nasdaq-listed specialty finance firm, has allocated approximately $441 million toward acquiring SUI tokens, the native cryptocurrency of the Sui blockchain. The move follows a $450 million private placement and marks the first time a publicly traded company has constructed a treasury strategy around the Sui network.

According to the official company announcement on July 29, Mill City raised the capital through the sale of 83 million shares to institutional investors. Participating firms included Pantera Capital, Electric Capital, ParaFi Capital, Arrington Capital, FalconX, and others. Galaxy Asset Management was appointed to manage the newly formed treasury.

The company stated that 98% of the capital raised would be used to acquire SUI tokens, while the remaining 2% would support Mill City’s traditional short-term lending business. The firm described the initiative as an “industry-first relationship” with the Sui Foundation and confirmed its position as the first public company to adopt a SUI-based treasury model.

Why Sui?

Mill City’s strategic pivot toward crypto was explained in the press release by incoming Chief Investment Officer Stephen Mackintosh, who said:

“Crypto and AI are reaching critical mass. We believe that Sui is well-positioned for mass adoption with the speed and efficiency institutions require for crypto at scale, plus the technical architecture capable of supporting AI workloads while maintaining security and decentralization.”

— Mill City Ventures Press Release, July 29, 2025

Adeniyi Abiodun, co-founder and Chief Product Officer at Mysten Labs, the developers of the Sui blockchain, added:

“The future belongs to crypto, AI, and stablecoins — and they all need infrastructure that can handle real scale. That’s Sui.”

— Mill City Ventures Press Release, July 29, 2025

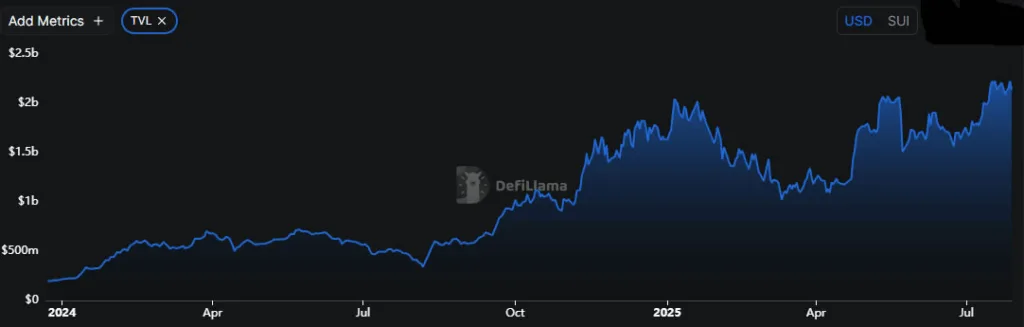

Total value locked on the Sui blockchain surpassed $2.22 billion on July 27, 2025 — a 400% increase since July 2024.

DeFi on Sui surges to record highs

Sui’s ecosystem has witnessed an explosive rise in decentralized finance (DeFi) activity. As of July 27, 2025, total value locked (TVL) on the Sui network hit an all-time high of $2.22 billion, according to DefiLlama (source) — reflecting a 400% increase since July 2024.

On the same day, asset manager 21Shares published a breakdown of Sui’s top protocols — Suilend, NAVI, and Haedal — which collectively held $1.7 billion in TVL following major gains over the previous month (source).

Despite the strategic commitment from Mill City, SUI’s market performance declined, mirroring a broader downturn in the altcoin sector. According to CoinMarketCap, SUI fell 11% over the past 24 hours and is currently priced at $3.95, down 27% from its all-time high of $5.35 recorded in January 2025 (source).

SUI fell from $4.45 to $3.89 over 24 hours, reflecting broader altcoin sell-off trends.