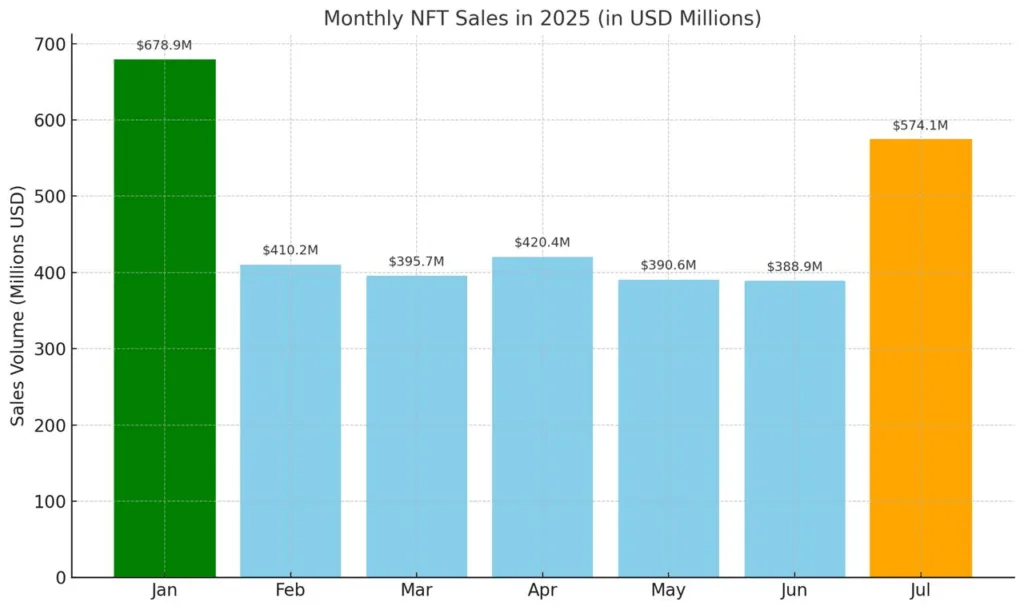

Non-fungible token (NFT) sales soared to $574.1 million in July, marking the second-highest monthly sales volume this year, according to data from NFT analytics platform CryptoSlam. The spike represents a 47.6% jump from June’s $388.9 million, signaling a renewed wave of investor interest despite a dip in overall transaction count.

While the sales total surged, the number of transactions dropped by 9% to 5 million compared to 5.5 million in June. This was accompanied by a significant rise in average sale value, which climbed to $113.08—the highest average price in six months. The data suggests that collectors are consolidating around higher-value assets, rather than engaging in lower-cost, high-frequency trades.

Signs of maturity emerge in NFT market

There was also a noticeable decline in market participants, with unique buyers dropping 17% to 713,085 in July, down from 860,134 in June. On the other hand, unique sellers increased by 9% to 405,505. This divergence points to a market dynamic where fewer, higher-capacity buyers are absorbing supply from a larger group of sellers.

Despite mixed participation metrics, the overall outlook for NFTs is trending upward. According to NFT Price Floor, the total market capitalization of the NFT sector has climbed to over $8 billion, up 21% from $6.6 billion on July 24. The gain reflects strengthening sentiment and possibly early signs of a sustained recovery across the digital collectibles market.

The surge in value and average transaction size, coupled with a rising market cap, suggests NFTs may be entering a new phase of maturity—where value increasingly outweighs volume.