- In August, Sky Protocol repurchased 73 million SKY tokens using 5.5 million USDS, as part of its token buyback initiative.

- Sky Protocol has spent nearly $75 million USDS in total to repurchase SKY, sending the token’s price 8 percent higher since the inception of the program.

- BitMine and Bitfarms are other crypto ventures that have similar ongoing stock buyback programs.

In August 2025, Sky Protocol executed a strategic buyback of 73 million SKY tokens using 5.5 million USDS of its native stablecoin, the company announced in an X post. This is part of a broader buyback campaign launched in late February, which has mobilized approximately 75 million USDS to date. In the past week, the protocol spent around $1.4 million USDS to repurchase 20.06 million SKY tokens, continuing its aggressive supply reduction strategy.

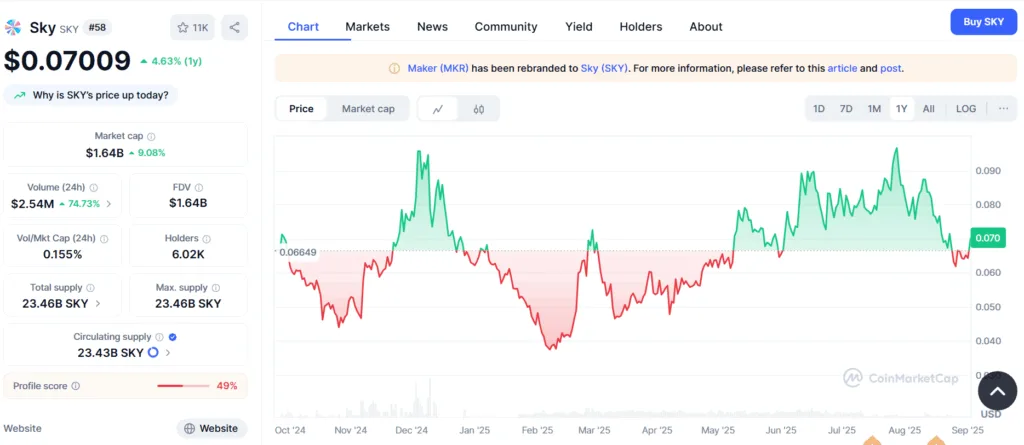

The rationale behind this initiative is to tighten the circulating supply and improve the token’s value. Since the program’s inception, SKY has gained around 8 percent, climbing from just above $0.063 to slightly over $0.0685. Its peak reached $0.096 by late July, nearing its December all-time high.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Source: CoinMarketCap

Once known as Maker, the protocol rebranded to Sky Protocol in August 2024. This is when the company disclosed its ambitions beyond its initial stablecoin roots.

Crypto buybacks are similar to traditional corporate strategy, where companies reduce the number of tokens or shares to help boost their price. This is also an act of legitimizing digital asset management to become more professional.

Crypto ventures embracing buybacks

In July, BitMine Immersion Technologies announced a $1 billion stock repurchase program. They opted to buy back equity even while its shares trade below NAV, rather than further increasing its vast Ethereum holdings. The company currently holds 625,000 ETH valued at $2.35 billion and 192 BTC.

In another instance, Bitcoin miner, Bitfarms, rolled out a stock buyback program targeting up to 10% of its outstanding shares or ~49.9 million shares between July 28, 2025, and July 27, 2026, signaling a strong belief in intrinsic value. The announcement sparked an ~18 percent jump in its stock.

Stacy Pereira

Stacy Pereira