TeraWulf Inc. (WULF), a Bitcoin miner and infrastructure provider, saw its stock soar as much as 33% on August 14. This comes on the back of an announcement that the firm has secured a massive $3.7 billion hosting agreement with AI cloud firm Fluidstack. The deal also includes a strategic move by Google, which will backstop $1.8 billion of Fluidstack’s lease obligations. This will allow Google to acquire an 8% equity stake in TeraWulf via warrants for about 41 million shares.

The agreement spans two 10-year HPC (high-performance computing) colocation contracts to host AI infrastructure at TeraWulf’s Lake Mariner data center in western New York. This facility boasts of liquid-cooled infrastructure, dual 345 kV transmission lines, and low-latency fiber connectivity.

TeraWulf’s CEO, Paul Prager, hailed the collaboration as “a defining moment” for the company, while Fluidstack leadership emphasized their commitment to delivering rapid and scalable AI hosting solutions.

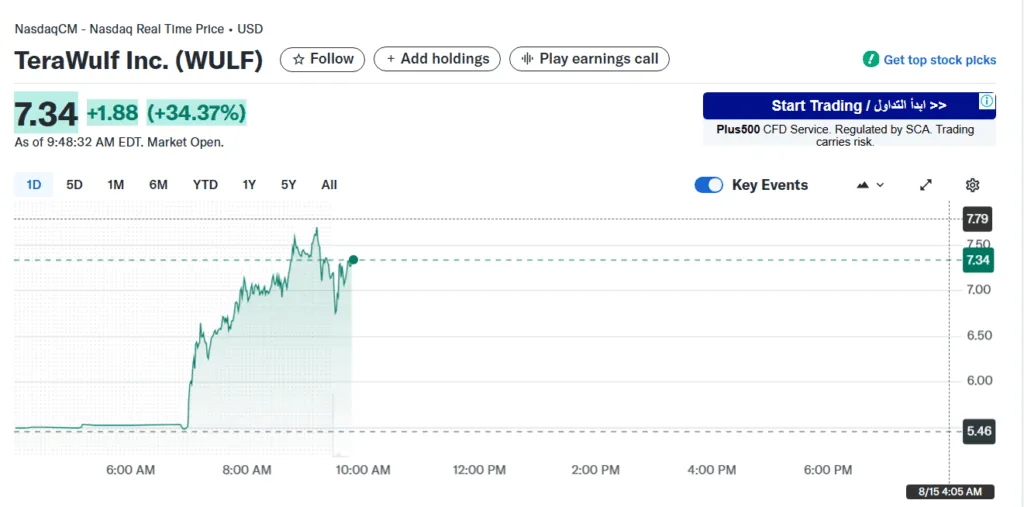

TeraWulf stock surges

The first 40 MW phase is slated to go online in the first half of 2026 and is tailored to meet hyperscale AI computing demands. The full facility will exceed 200 MW in gross capacity and is expected to be ready by year-end 2026.

The agreement is a huge financial win for TeraWulf. With the lease payments increasing each year, the company is expected to keep 85% of earnings. This could add up to ~$315 million in profit every year. Plus, with optional extensions, the contract could climb to a total value of $8.7 billion, marking massive growth potential for TeraWulf.

The move marks a pivotal transition for the company, from Bitcoin mining to becoming a key player in scalable, AI-focused data infrastructure.