Tesla’s board of directors has approved a 96 million‑share restricted stock award for CEO Elon Musk, valued at ~$29 billion based on the recent share price. This is part of an interim compensation package approved under the company’s 2019 Equity Incentive Plan, the EV maker said through a SEC filing.

The grant represents a strategic response to a Delaware Chancery Court ruling in early 2024 that invalidated Musk’s original $56 billion CEO performance award, a Forbes report stated. The court had dismissed the award on grounds of procedural flaws and inadequate independence among board members.

Rigorous conditions attached to grant

Since then, Tesla formed a special committee, chaired by board members Robyn Denholm and Kathleen Wilson‑Thompson, to craft this “Interim CEO Award.” The new compensation mirrors the 2018 package but includes new constraints. These include Musk remaining in a senior executive role until at least August 3, 2027. He will have to pay $23.34 per share and refrain from selling the shares until August 3, 2030.

As of December 31, 2024, Musk owned 714,754,706 Tesla shares, representing roughly 20.3% of the company’s outstanding stock, making him its single largest individual shareholder. When the new award vests in 2027, his total holdings would climb by another ~25%, potentially bringing his stake to over 25%, though Tesla has confirmed the shares would be forfeited if the original compensation plan is later reinstated.

Losing Elon is a loss of a leader: Tesla Board

The board emphasized that Musk has received no meaningful compensation in eight years, despite building Tesla into a dominant player in EVs, AI, energy, and robotics. In a letter to shareholders, they stated, “To recognize what Elon has accomplished … we believe we must take action to honor the bargain that was struck in 2018. After all, a deal is a deal.”

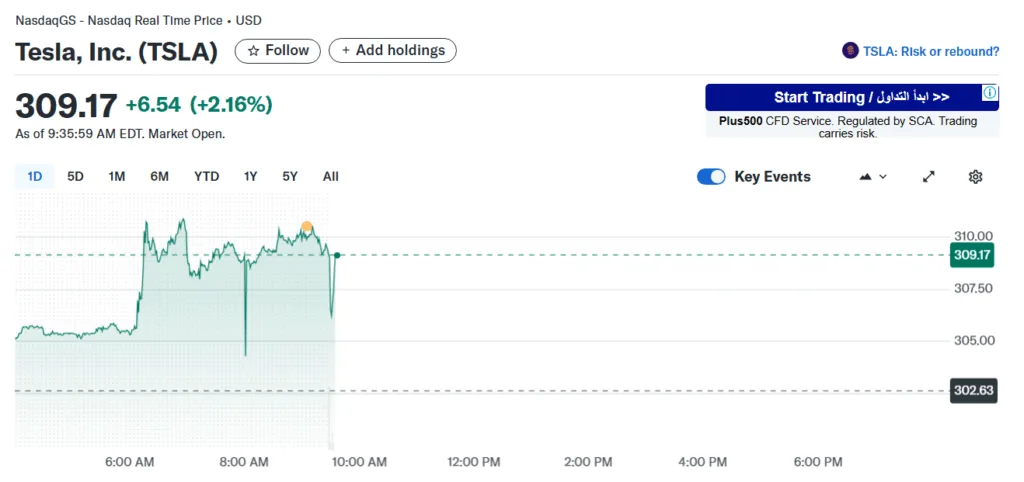

On news of the award, Tesla shares rose roughly 2% in trade amid ongoing investor tension over Musk’s political positioning, declining sales growth, and intensifying AI‑talent competition. Tesla shareholders are scheduled to vote in November 2025 on a related long‑term stock plan if the Delaware Supreme Court ultimately reinstates the 2018 award. Then the interim grant would be rescinded to prevent a “double‑dip.”