The new hires bring experience in both traditional banking and institutional crypto as the layer-1 blockchain grows its strategy after launch.

After the introduction of its mainnet in November, the Monad Foundation is hiring three top executives from Optimism, FalconX, and BVNK to help it focus more on getting institutions to use its technology.

Senior hires from Optimism, FalconX and BVNK

Urvit Goel arrives from the Optimism Foundation to be the vice president of go-to-market. Joanita Titan, who was in charge of custody and staking at FalconX, becomes the head of institutional growth. Sagar Sarbhai, who was at BVNK, becomes the head of institutions for Asia-Pacific.

The three executives used to work at JP Morgan, Deutsche Bank, Anchorage Digital, Fireblocks, and Amazon. They have experience in both traditional finance and institutional crypto infrastructure.

The new hires will work on capital markets strategy, expanding the brand, and getting institutions to use the service in Asia-Pacific countries like Hong Kong, Singapore, Japan, and South Korea.

Source: Monad

Network metrics and funding background

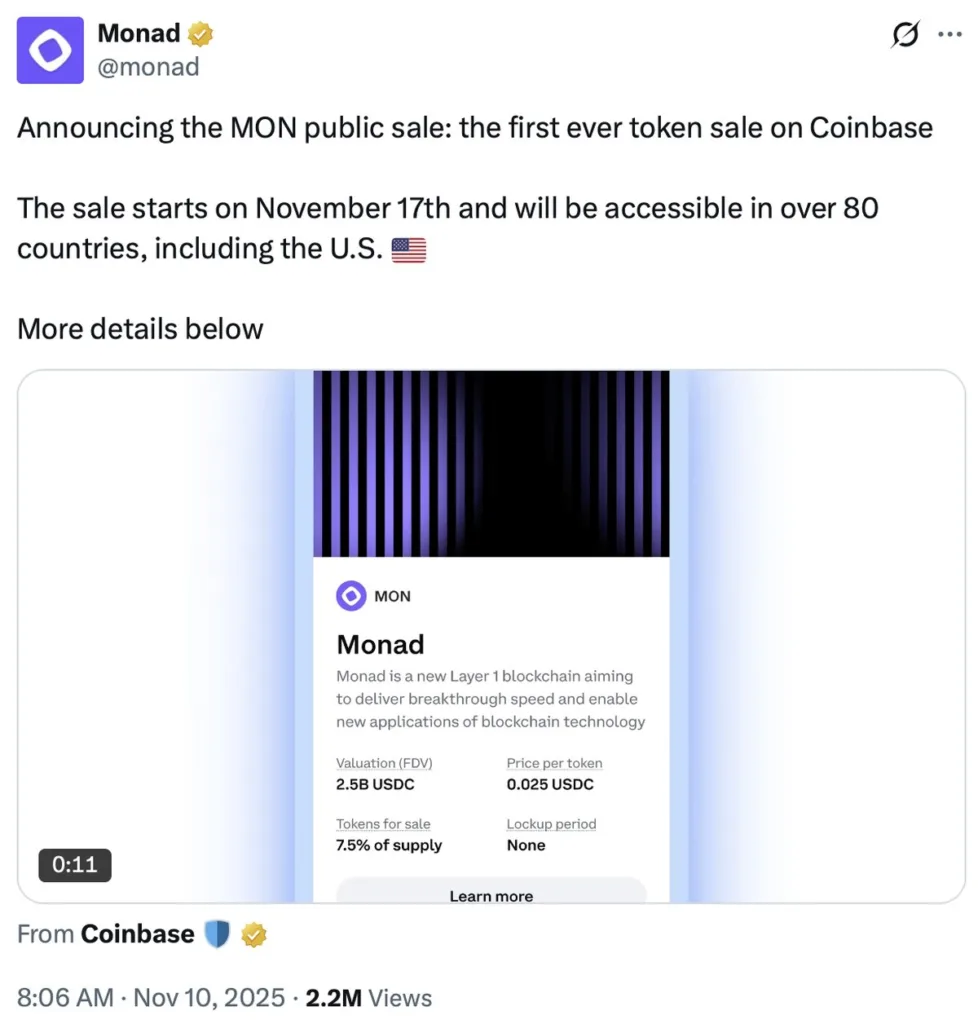

In November, Monad launched its public mainnet and held a token sale on Coinbase. The foundation says that since the network’s launch, it has reached a market capitalisation of around $450 million in stablecoins and a total value of more than $200 million locked across decentralised finance protocols.

The network believes it can handle up to 10,000 transactions per second with finality in less than a second while still being able to interact with the Ethereum Virtual Machine. The organization noted that the design is meant to be used for things like high-frequency trading and payments.

Approximately in 2024, Paradigm led a funding round for Monad Labs, the business that built the network, that brought approximately $225 million. After the mainnet launch, the Monad Foundation is now in charge of ecosystem expansion.

Competitive pressures in the layer-1

There were a lot of new layer-1 blockchains launched between 2021 and 2023, notably Avalanche.

AVAX $9.04, Near NEAR $1.04, Aptos APT $0.92, Sui SUI $0.96, and other new mainnets have been coming out less quickly over the past year. Even so, Monad isn’t the only new layer-1 blockchain to join the market.

In late 2024, ZetaChain released its mainnet, which was designed to connect different crypto networks without using bridges or wrapped assets. In February 2025, the Berachain Foundation released its EVM-compatible layer-1, giving away almost 80 million BERA tokens to eligible users in an airdrop worth about $632 million.

In February 2026, Aster, a decentralised exchange, said that its Layer 1 testnet was now open to the public and that the mainnet would start in the first quarter. The roadmap shows intentions for fiat on-ramps, open-source code releases, and more ecosystem growth over the course of 2026.

But not all investors are sure that the new layer-1 blockchains will last. Arthur Hayes, a crypto investor, claimed in November that most new L1 networks are likely to fail. He predicted that only a small group, including Bitcoin BTC$66,896, Ether ETH$1,946, Solana SOL$83.22, and Zcash ZEC$282.47, will stay significant over the long term.

The recent performance of tokens demonstrates the difficulty new chains face in gaining traction.

CoinMarketCap says that ZetaChain’s ZETA$0.05 native coin is down nearly 98% from its all-time high, and Berachain BERA$0.67 is down approximately 95%. At the time of writing, Monad’s token (MON) is trading about 52% lower than its peak.