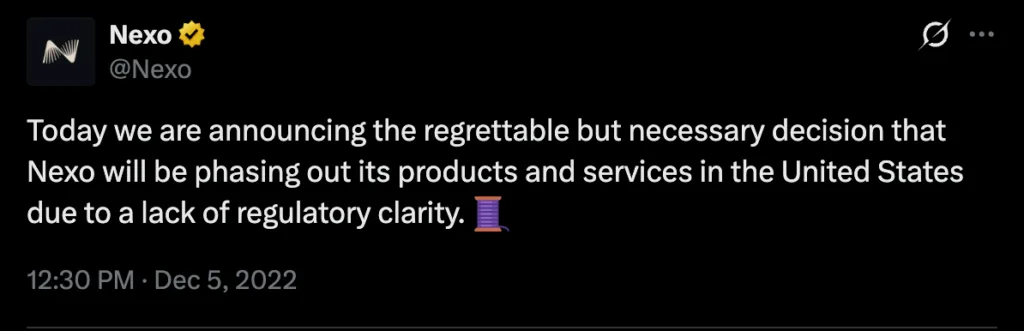

In 2022, Nexo left the US because federal and state financial regulators were hostile to the crypto business.

Nexo will reopen its digital asset services and crypto exchange platform in the US on Monday, more than three years after leaving the market because of problems with federal and state regulators.

Nexo relaunches US digital asset platform

The company’s rebooted platform will offer flexible and fixed-term yield programs, a spot cryptocurrency exchange, crypto-backed credit lines, and a loyalty program for US users. This is because the US has made its rules for digital assets clearer.

Bakkt, a US-based digital asset platform focused on institutional clients, will provide the platform’s trading infrastructure. Genova stated, “Nexo’s US offering is set up through collaborations with US service providers that have the right licences. A third-party investment adviser registered with the Securities and Exchange Commission (SEC) offers some services. This adviser gives advice in accordance with US securities regulations.

The company says that the new US operations will be situated in Florida and led by a management team that will be named soon.

In April 2025, Nexo first talked about coming back to the US in a private event where Donald Trump Jr., the son of US President Donald Trump, was the main speaker. Trump Jr. said at the event that cryptocurrency is the future of money.

2022 pullout under Gensler-era enforcement pressure

Nexo exited the US market in December 2022, when the crypto bear market was at its worst. They said they did so because of the unfavourable regulatory environment for the cryptocurrency industry under former SEC head Gary Gensler.

The company said it had to leave the US since it had been having “good faith” talks with state and federal agencies for 18 months that didn’t lead to any changes.

At the time, the company remarked, “It is now unfortunately clear to us that, despite rhetoric to the contrary, the US refuses to provide a path forward for enabling blockchain businesses.”

The SEC and Nexo had a lot of disagreements over the company’s “Crypto Earn” scheme, which let users earn compounding interest on certain cryptocurrencies that they lent to the site.

Nexo agreed to pay the SEC $45 million in January 2023 because it didn’t register its interest-bearing crypto rewards scheme with the agency. The business also agreed to pay $22.5 million to settle a multi-state securities case that had to do with the earn interest scheme.

One month later, the business pulled down its Crypto Earn program for US users.

Source: Nexo

CLARITY Act debate shapes regulatory outlook

Nexo is coming back to the market at the same time as Washington is trying to approve a bill that would set rules for how US market authorities will watch over crypto. In July, the House passed a law called the CLARITY Act that was identical to this one. However, the effort has stopped since the Senate Banking Committee hasn’t been able to get enough support from both parties to move it forward.

Patrick Witt, a White House crypto adviser, said on Friday that both sides need to give in on the subject and work to get it passed before the midterm elections in November. Concerns raised by crypto sector leaders are also making the situation worse, according to US Treasury Secretary Scott Bessent, who spoke to CNBC on Friday.

A meeting last week between officials from the crypto and banking industries, arranged by the White House, was called “productive,” but the issue of stablecoin provisions in the market structure law is still not resolved.