Norway’s sovereign wealth fund NBIM has said on Tuesday it will oppose Elon Musk’s ambitious pay package of roughly $1 trillion via share compensation—a decision that will be made later this week during a shareholder meeting.

The update comes as various shareholders, both small and large, voice their concerns and thoughts on whether such a deal would be beneficial for the long term outlook of Tesla.

The company’s board of directors have said Musk will only receive the share award if he is able to unlock substantial growth for the company, including a $8.5 trillion market value.

NBIM has voted against compensation for Musk on two occasions in 2018 and 2024. In their decision a year ago, they said in an official statement.

“While we appreciate the significant value generated under Mr. Musk’s leadership since the grant date in 2018, we remain concerned about the total size of the award, the structure given performance triggers, dilution, and lack of mitigation of key person risk. We will continue to seek constructive dialogue with Tesla on this and other topics,”

Tesla’s Q3 earnings report—the EV’s most recent measure of financial performance—showed that while revenue rose to $28.1 billion, a decline in operating income and a lower-than-expected EPS of $0.50 reflected pressure on margins.

Musk also bought $1 billion worth of Tesla shares in September indirectly via a trust, a purchase made after years of selling the company’s stock.

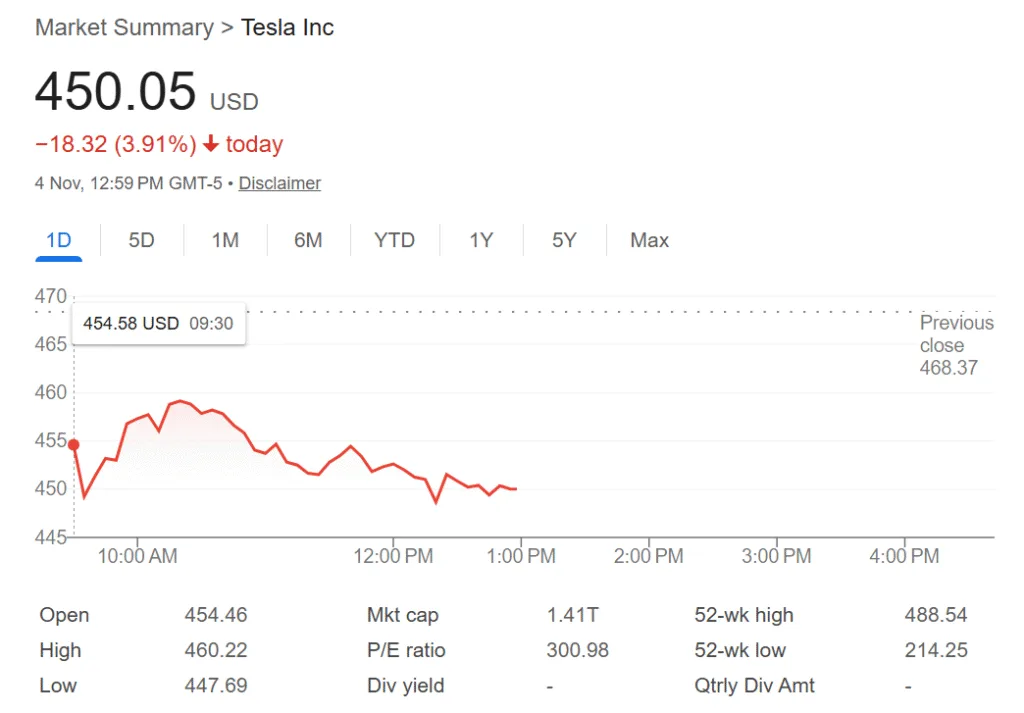

Source: Google Finance

At the time of writing, Tesla shares were trading at $450.05.