AI giant Nvidia will report its Q3 earnings on Wednesday, November 19, after markets close. The one question on everyone’s mind, though, is how will the company translate CEO Jensen Huang’s dramatic “half-a-trillion” forecast into concrete revenue and guidance for 2026? Analysts on Wall Street expect revenue of $55.45 billion, a 58.1% (YoY) increase, with adjusted earnings projected at $1.25 per share.

Huang’s ‘half a trillion’ forecast

CEO Jensen Huang stunned investors earlier this week, reiterating his vision that Nvidia’s AI-driven growth could push the company toward a $500 billion annual revenue trajectory. Huang first gave this prediction at Nvidia’s recent GTC event, putting pressure on the chipmaker to show that its order backlog is real and sustainable.

Analysts and investors will press management for details on timing, the customer mix of current hyperscalers versus new entrants, and any geographic constraints caused by export rules. The bold forecast shows that Nvidia is not just looking to dominate the chipmaking business, but wants to be the infrastructure powering generative AI, robotics, and machine learning.

Markets wait with bated breath

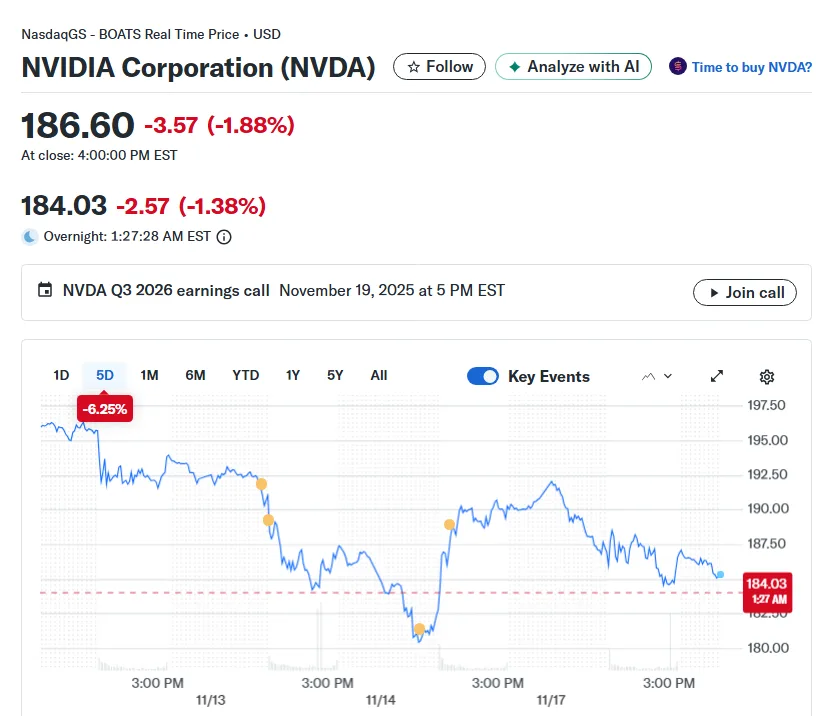

Ahead of earnings, U.S. stock futures have been volatile, with the S7P 500 and the Nasdaq closing in the red on Monday. Investors and traders showed caution ahead of the report, with markets pricing in the risk that any softness or conservative guidance could ripple through AI-linked stocks.

Historically, Nvidia’s earnings have rippled across the Nasdaq and S&P 500, given its outsized role in the AI boom. Over the past two years, Nvidia has beaten revenue estimates every quarter by an average of 4.7%, fueling rallies in tech stocks. In after-hours trade on Monday, Nvidia traded at $184.03, down 1.38% and has shed 6.25% this week. On a YTD basis, the stock has shown a positive 38% uptick and remains a bellwether for tech sentiment.

Source: Yahoo Finance

Multiple investors exits

Another question that’s going to be on shareholders mind is the series of high caliber investors that have exited the cap table. In early November, SoftBank sold its entire stake in the chipmaker to raise $5.8 billion and more recently, Peter Thiel’s investment fund, sold its entire stake in Nvidia. Investors are paying heed to the AI bubble narrative as valuation seem far stretched, also helping Nvidia reach that coveted $5 trillion market capitalization sometime in October this year.