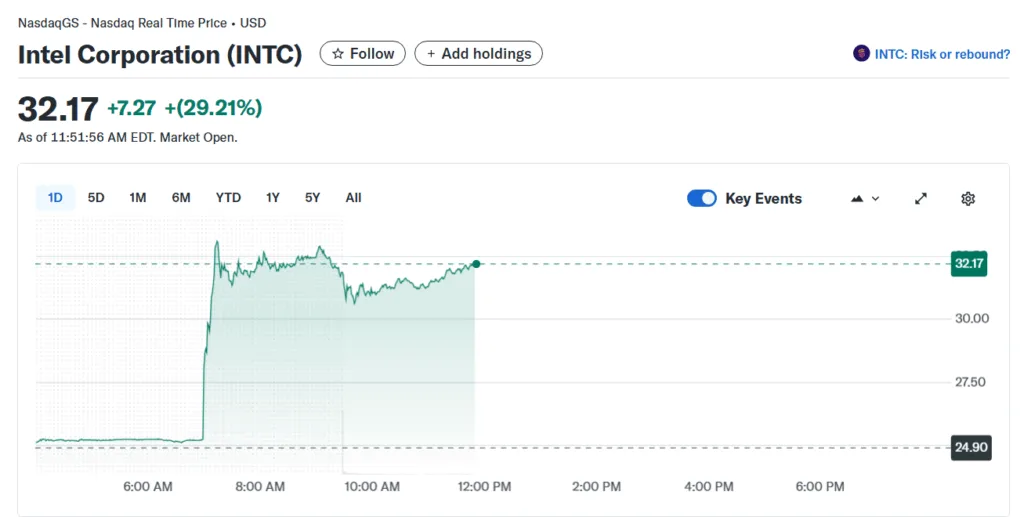

Nvidia and Intel jointly announced in a press release Thursday that the AI chip giant would invest $5 billion to buy common shares of Intel. The news immediately boosted Intel’s stock by over 25%.

The shares will be purchased at $23.28 per share, as part of a new partnership to collaborate on AI infrastructure and PC products. The agreement stipulates that once new shares are issued, Nvidia will hold “roughly 4% or more” of Intel.

According to the contours of the deal, it calls for co-developing custom processors for both data centers and PCs. Intel will design CPUs and integrate Nvidia’s graphics/AI chiplets in certain PC products. For the data centers, Intel is to build custom chips that Nvidia will use in its AI infrastructure. This helps meld Intel’s strong CPU/x86 ecosystem with Nvidia’s AI-leading GPU/accelerated computing stack.

A new lease of life

Intel has been reeling under pressure, slipping behind in several technology areas, especially in AI and GPUs, compared to competitors like AMD, TSMC, and others. Moreover, the financial losses kept mounting, making it imperative for the federal government to step in. The government’s stake is part financial aid, part strategic industrial policy, intended to shore up domestic semiconductor manufacturing capacity and ensure U.S. leadership in advanced chipmaking.

In mid-August, the U.S. government made an extraordinary investment in Intel by acquiring about 9.9-10% of the company. The government paid $8.9 billion under the CHIPS and Science Act and the Secure Enclave program. That stake was secured at $20.47 per share.

If Intel can execute all that it has on its hands, it will get them a fresh lifeline and potential to reclaim some ground. Also, this could prompt further consolidation, partnerships, or shifts in foundry & IP dynamics.

Global share of the “chip pie”

With Nvidia now pumping in the dollars into Intel, it shows that turnaround efforts could bear fruit. It’s one thing for the government to invest and a totally new ball game for a leading private tech company, deeply embedded in AI hardware, to stake its capital.

Intel has long been a major player in CPUs and PCs, but lost dominance in foundry and AI accelerators to companies like TSMC and Nvidia. This deal doesn’t immediately give Intel full control over those segments, especially not Nvidia’s foundry needs. Still, Intel is better positioned now to compete for AI‐infrastructure chips, custom designs, and PC integrations.

For Nvidia, this expands influence. It already dominates in GPUs and AI accelerators, but this partnership gives it greater ability to shape CPU + AI co-design. The company can now embed its tech deeper into the PC ecosystem, possibly reduce some dependencies (e.g., on TSMC), and strengthen its hand in U.S. regulatory / trade environments.

Intel’s stock responded strongly, rising 25-28% on the news. Whereas Nvidia stock rose by close to 3% trading at $175.79.