- Bitwise claims that Pokémon cards might be the next $21.4B market to transition on-chain.

- Collector Crypt’s CARDS token skyrocketed 10-fold to a $450 million valuation in just one week.

- NFT volumes increased by 9% in August to reach $578M, marking the highest total since January, despite a decline in sales counts

Pokémon trading cards may soon become the next tangible asset to transition onchain, possibly introducing a $21.4 billion market to cryptocurrency. Bitwise research analyst Danny Nelson mentioned on Thursday that trading cards are approaching their “Polymarket moment,” alluding to the recent rise of blockchain prediction markets into the mainstream.

Nelson observed that by 2025, tokenization has expanded into a $28.2 billion market, yet it is primarily focused on conventional finance assets like treasuries, commodities, and real estate. He argued that although tokenization in those sectors offers advantages such as around-the-clock trading and lower costs, they already possess efficient digital infrastructures. In contrast, Pokémon and various card games continue to depend significantly on physical deliveries and unregulated sales.

“This market continues to be predominantly informal.” You won’t find Pokémon ETFs or investment funds, and it’s likely you won’t see them for some time. “Yet perhaps not as extensive as one might assume,” Nelson remarked, referencing the marketplace Whatnot, which generated $3 billion in sales last year.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Early momentum and market signals

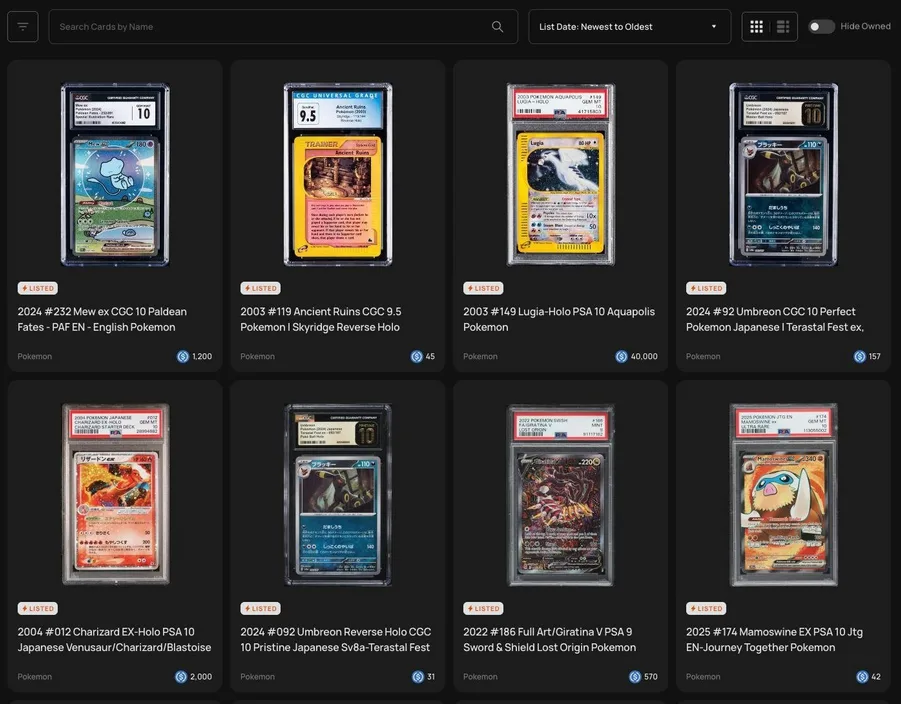

The initial phase of onchain trading has started with Collector Crypt, a platform on Solana for tokenizing Pokémon cards. Its native token, CARDS, skyrocketed ten times to a $450 million fully diluted valuation just one week post-launch. Nelson mentioned that traders are hurrying to account for revenue potential, indicating an annualized figure of $38 million. The Gacha Machine project by Collector Crypt has generated $16.6 million in revenue within merely a week.

In the meantime, the larger NFT market is displaying indications of activity. As reported by DappRadar, NFT trading volumes increased by 9% in August to $578 million, marking the highest level since January. Nonetheless, total sales decreased by 4%, indicating a reduction in transactions but an increase in the value of trades, a trend that might favor tokenized trading card markets

Rita Dfouni

Rita Dfouni