As post-halving margin pressure changes the business, public Bitcoin miners are building 30 gigawatts of AI-focused power capacity, which is almost three times what they have now.

As they try to make up for falling mining profits and get ready for the next boom cycle, public Bitcoin miners are expecting to add around 30 gigawatts of new power capacity for artificial intelligence workloads. This is almost three times the 11 GW they now have online.

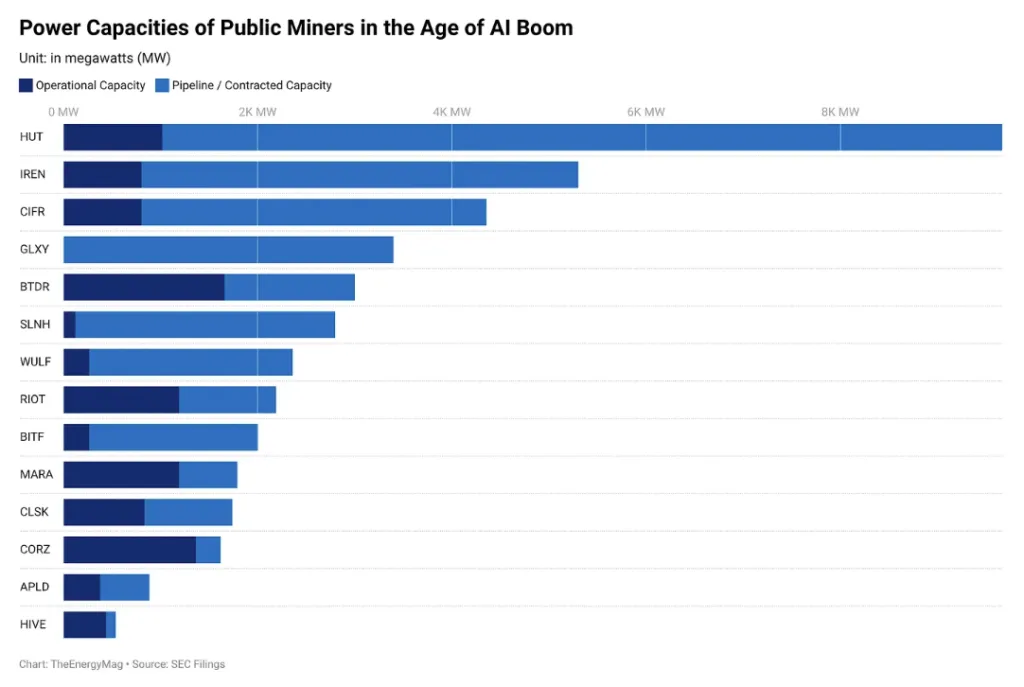

TheEnergyMag put up this list of 14 publicly traded Bitcoin miners. It shows how quickly the industry is moving away from traditional hash power because hash prices are still low.

The projected expansion would add what TheEnergyMag called “a small country’s worth of power infrastructure” on paper. In actuality, a lot of the 30 GW is not operating facilities but rather in development pipelines, interconnection queues, or early-stage plans.

The growing disparity shows that the focus of competition is moving from ASIC efficiency to getting power, money, and data centers built on schedule.

TheEnergyMag wrote, “This is the megawatt arms race of the AI boom.” They also added that making money from AI hinges on whether demand is high enough to make the investment worth it.

Source: TheEnergyMag

Early revenue signals from AI pivot

The move toward artificial intelligence infrastructure shows that experienced Bitcoin miners are using more and more hybrid strategies. Some organisations are already seeing significant revenuess from AI and high-performance computing (HPC) workloads.

HIVE Digital is one example. Its AI and HPC business lines helped company make record quarterly revenue lately. The company said that sales in the fourth quarter were $93.1 million, which is 219% more than the same time last year, even though Bitcoin values fell during that time.

Investors are also aware of the change. Starboard Value told Riot Platforms management earlier this week that they should speed up the miner’s growth into HPC and AI data centers.

The desire to diversify comes after the 2024 Bitcoin halving, which lowered block rewards and made it harder for miners to make money.

Things have become even worse since the fourth quarter, when a lot of people sold Bitcoin, causing it to drop from its all-time high of almost $126,000. Prices finally settled down in February, after dropping below $60,000 for a short time.

Even with these problems, US-based miners were able to bounce back at the beginning of the year. After a bad winter storm briefly stopped operations, production picked up again.