- Proposed closed-end fund to give retail investors access to Robinhood’s venture capital portfolio.

- Shares of RVI would trade on the New York Stock Exchange if SEC approval is granted.

- Fund could include investments in AI, blockchain, Web3, and digital assets, broadening access beyond accredited investors.

Brokerage firm Robinhood is planning a closed-end fund that would allow retail investors to access its venture capital portfolio traditionally reserved for institutional and high-net-worth investors.

The brokerage disclosed Monday that it has filed a Form N-2 with the US Securities and Exchange Commission (SEC) to register shares of the Robinhood Ventures Fund I (RVI), which will be managed by its new subsidiary, Robinhood Ventures DE.

If approved, shares of RVI would be listed on the New York Stock Exchange (NYSE), enabling investors to buy and sell them through participating brokerage platforms.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Expanding access to venture capital

Robinhood said the fund will back companies “at the frontiers of their respective industries,” though it did not specify sectors. Venture funds often focus on high-growth areas such as emerging technologies, blockchain, and Web3.

Opening these investments to retail investors would represent a major shift in access. Traditionally, early-stage, private companies have been available only to venture capital firms and wealthy backers.

Robinhood’s venture strategy could also extend into digital assets, where the brokerage has been expanding aggressively. The company already offers cryptocurrency trading, acquired major exchange Bitstamp, and bought Canadian crypto firm WonderFi for $179 million.

The firm has further experimented with tokenized stocks and “private stock tokens,” a move that has drawn scrutiny from some industry observers.

Venture capital landscape and crypto trends

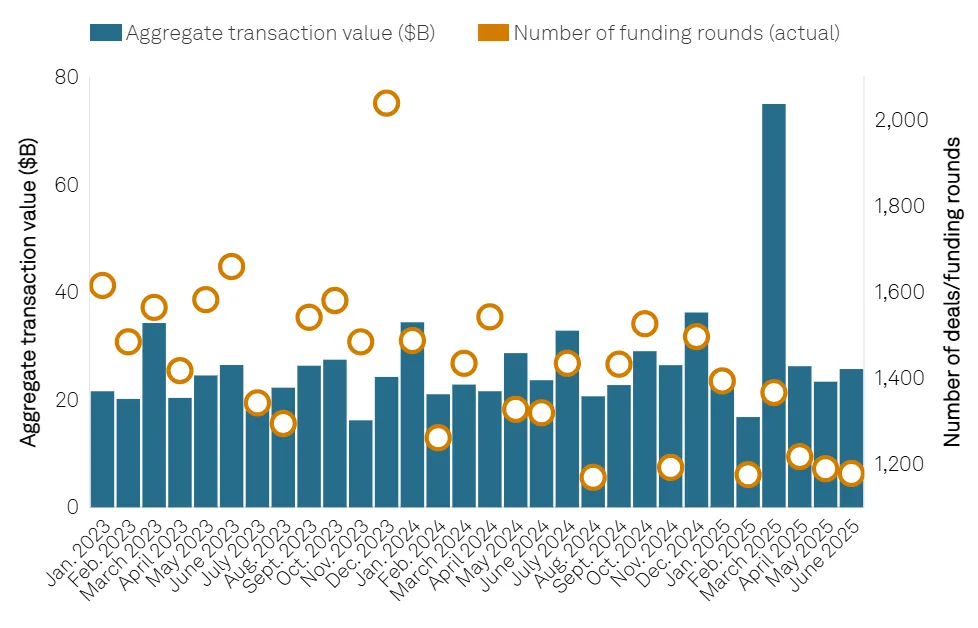

Venture capital funding rebounded in 2025, driven by a surge in US startups focused on artificial intelligence. Global VC investment totaled $189.3 billion in the first half of the year, up from $152.4 billion in the same period in 2024, according to S&P Global.

Source: S&P Global

Crypto venture funding, while still a small component of overall VC, saw $10 billion raised in Q2 its strongest showing since 2022, according to CryptoRank. Key trends driving investment include tokenization, stablecoin infrastructure, and decentralized finance.

Under US securities law, most early-stage private offerings remain limited to accredited investors, restricting retail participation. Robinhood’s proposed venture fund could provide an indirect path for retail investors to access a traditionally exclusive asset class.

Nazia Saeed

Nazia Saeed