RWA protocols have surpassed decentralised exchanges in total value locks. This is attributable to the rising significance of tokenised Treasurys, private credit, and commodities as the principal foundational components within the blockchain.

According to DefiLlama, real-world asset (RWA) protocols are anticipated to be among the primary beneficiaries of decentralised finance (DeFi) in 2025. They will outperform decentralised exchanges (DEXs) to become the fifth-largest category in total value locked (TVL).

RWAs currently have a total value fixed of approximately $17 billion, representing an increase from $12 billion in the fourth quarter of 2024. This illustrates how rapidly tokenised Treasurys, private credit, and other real-world assets have evolved from specialised projects to essential elements of DeFi.

Vincent Liu, who is responsible for investments at Kronos Research, told Cointelegraph that “balance-sheet incentives rather than experimentation” are driving RWA growth. Higher-for-longer rates are making tokenised Treasury securities and private credit attractive as on-chain, yield-bearing assets, and regulatory clarity is making it easier for institutional allocators to invest.

Source: RWA.xyz

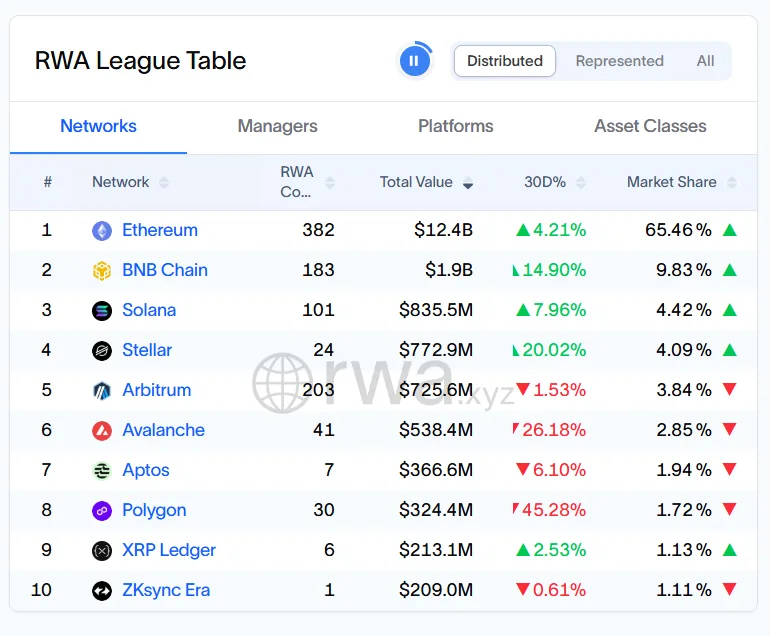

Ethereum dominates public-chain RWA issuance

Earlier this year, RWAs (excluding stablecoins) had grown to roughly $24 billion. Private credit and tokenised treasuries were the main drivers of growth, and Ethereum was the main public settlement layer for on-chain debt and fund structures.

That market has stayed focused on a small number of big issuers and vehicles on Ethereum until 2025, while RWA.According to xyz data, there is a second layer of networks, such as BNB Chain, Avalanche, Solana, Polygon, and Arbitrum, that each hold a small percentage of the total value of public-chain RWA.

At the same time, permissioned infrastructure, like Canton Network, has become a key institutional centre, with over 90% of the overall market share. It hosts massive RWA programs in a regulated, privacy-preserving environment that can connect to DeFi data and liquidity rails.

Tokenised treasurys and commodities gain momentum

Tokenised US Treasurys are still the main product. By December, the combined tokenised Treasury segment will be worth more than a billion dollars, thanks to funds like the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), Circle’s USYC, Franklin Templeton’s BENJI, Ondo’s OUSG, and others.

Liu said that “the constraint is no longer tokenisation itself, but liquidity, and integration into TradFi.” He also said that in 2026, “attention should shift from headline TVL to control and usage, who owns issuance, where RWAs are deployed as collateral, and which venues capture secondary market flow.”

The rise in gold and silver prices is giving the RWA trade a new leg, which is bringing more money into tokenised commodities. Recent numbers show that the market valuation of tokenised commodities is close to $4 billion. Gold products such as Tether Gold and Paxos Gold have increased in tandem with commodity metals, propelling prices towards new record highs.

Liu observed that these developments are effectively transforming tokenised commodities from specialised RWAs into assets of macroeconomic significance, characterised by genuine demand for on-chain access and resolution within a continuous, 24/7 market. This is due to more transparent pricing and custody regulations, which facilitate their integration with DeFi and institutional platforms.

He stated that “behavioural validation” will remain crucial until 2026, when the prices of gold and silver will surpass previous records. He stated that strong prices lead to increased issuance, which in turn attracts liquidity and supports adoption beyond merely yield-focused narratives.

He also noted that interoperability is another important clue. He said that “real acceleration” will happen when “tokenised commodities can easily move between venues and chains, acting as neutral collateral instead of separate products.”