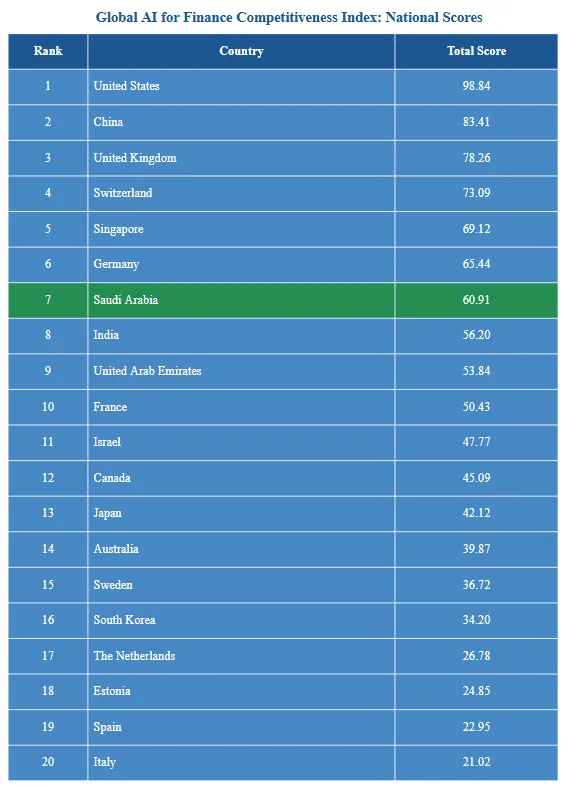

Saudi Arabia and the UAE have broken into the top 10 of the Global AI for Finance Competitiveness Index (GAICI), ranking 7th and 9th respectively, according to a report released by Deep Knowledge Group with Hong Kong’s Financial Services Development Council as observer.

The index benchmarks AI adoption in finance, combining metrics on competitiveness, maturity, and real-world deployment across 20 countries and 15 city-level financial hubs.

The inclusion of the two nations marks a stark shift for the GCC nations, which have been focusing on AI and financial development for over a decade now.

Saudi Arabia poised to become AI finance leader in the Gulf

Saudi Arabia is emerging as the fastest-growing AI finance contender in the Gulf region, according to the report. The growth of Saudi Arabia is backed by government investment, institutions, and a plan to modernize the financial system.

Saudi Arabia is not yet a mature global financial hub; however, it has the potential to be a major player in the region in the field of AI finance.

UAE emerges as global testbed for AI-powered financial systems

The UAE, on the other hand, is a ‘system builder’ that excels in transforming AI possibilities into fully functioning and regulated financial systems.

While its peers focus on the output of AI research, the UAE focuses on the speed of adoption, regulatory innovation, and the efficient implementation of AI-driven tools, thereby becoming a testbed for finance-grade AI.

Top AI finance leaders excel at turning tech into real-world systems

Global leaders in the index, led by the U.S., China, the U.K., Switzerland, and Singapore, share a common trait. They convert AI capacity into real-world, production-grade financial systems.

The strength in several areas, ranging from ecosystem to governance, distinguishes top performers from one-off innovators.

Experts point out that AI in finance is no longer just a novelty but an integral infrastructure. Competitive advantage now lies in embedding AI into regulated processes, making models audit, resilient, and operationally governed.

Dr Patrick Glauner, Professor of AI at Deggendorf Institute of Technology, a co-author of the report, noted, “In finance, competitive advantage comes from trustworthy AI—models that are explainable, auditable, and robust under real-world constraints. The index makes clear that deployment quality matters as much as innovation.”

The report underscores that the next phase of competition will hinge on institutionalizing AI, turning tools into repeatable and scalable financial systems rather than isolated pilots.

The city hub rankings also indicate the same trend. New York, London, and Hong Kong are at the top of the rankings, driven by the benefits of market connectivity, capital concentration, and institutional density.

Riyadh and Singapore are mid-tier hubs with high potential, yet they are still struggling with the breadth of the ecosystem and the deployment pathways.