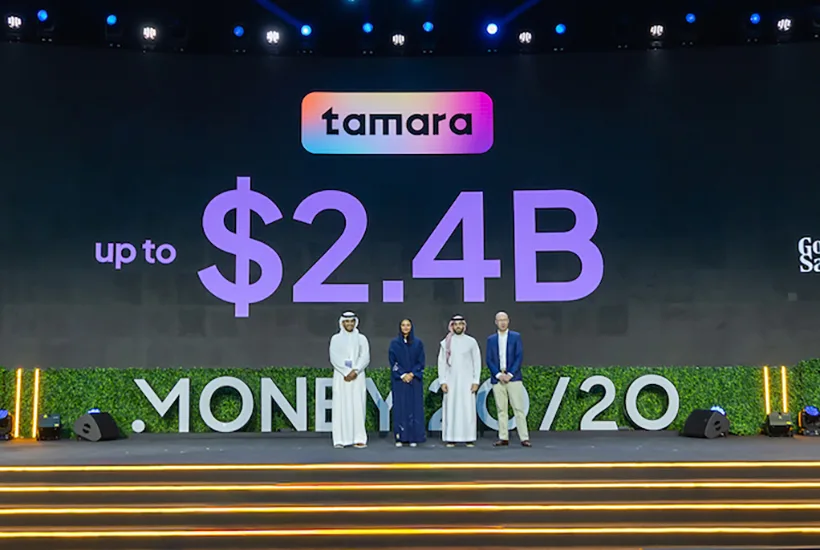

Tamara, Saudi Arabia’s first homegrown fintech unicorn, has secured a landmark asset-backed facility of up to $2.4 billion, marking the largest of its kind in the region. The deal, announced at the Money 20/20 Middle East conference, includes an initial $1.4 billion with an additional $1 billion available over three years, pending approvals.

Financial super-app in the making

The financing, backed by global heavyweights Goldman Sachs, Citi, and Apollo funds, fully refinances Tamara’s previous $500 million facility and sets the stage for aggressive product expansion. The Riyadh-based company plans to channel the capital into diversifying its credit and payment offerings, reinforcing its ambition to become the most customer-centric financial super-app on the planet.

“This landmark facility accelerates our growth trajectory,” said Abdulmajeed Alsukhan, Tamara’s Co-Founder and CEO. “It brings us one step closer to helping people own their dreams.”

Part of KSA’s Vision 2030

Tamara’s growth aligns with Saudi Arabia’s Vision 2030 and the Financial Sector Development Program, which aims to empower private sector growth and attract global investment. The facility also underscores a strategic shift toward localized investment practices, promoting sustainable development across the regional fintech ecosystem.

Since its $340 million Series C round in December 2023, Tamara has scaled rapidly, now serving over 20 million customers and enabling transactions at more than 87,000 merchants. With this new funding, the company is poised to deepen its regional footprint and redefine digital finance in the Gulf.