Simon Gerovich of Metaplanet responded to critics who said the company was withholding losses and important information about its Bitcoin bets. This comes as investors becoming more and more angry about leveraged Bitcoin treasuries.

Simon Gerovich, the CEO of Metaplanet, denied claims from what he dubbed “anonymous accounts” that the firm lied to investors about its Bitcoin strategy and disclosures.

Some people on X have said that Metaplanet kept back or delayed price-sensitive information about big Bitcoin (BTC $67,401) purchases and options trades that were paid for with shareholder money. They also said that the company hid losses from its derivatives strategy and didn’t properly disclose the conditions of its BTC-backed borrowings.

Gerovich wrote a long X post on Friday in which he said that Metaplanet quickly declared all of its Bitcoin purchases, option strategies, and borrowings. He also said that critics were interpreting its financial accounts instead of finding wrongdoing.

Source: Metaplanet

Purchases and disclosures in September

Gerovich indicated that Metaplanet bought four Bitcoins in September 2025 and “immediately announced” each one. He denied rumors that the corporation covertly bought at the local peak without telling anyone.

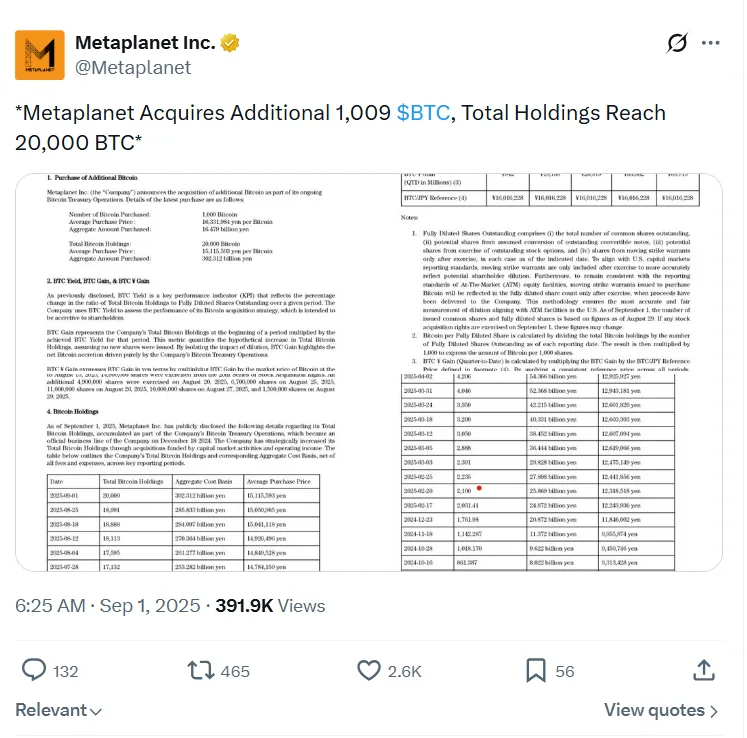

Metaplanet’s public dashboard shows that it bought 1,009 BTC on September 1, 136 BTC on September 8, 5,419 BTC on September 22, and 5,268 BTC on September 30, 2025.

Bitcointreasuries.net, a public tracker, also shows the acquisitions, as do the public announcements and financial statements.

Gerovich also said that selling put options and put spreads was meant to buy BTC below spot and make money off of volatility for shareholders, not to bet on short-term price changes.

Performance metrics beyond net profit

The CEO of Metaplanet also disagreed with using net profit as a measure for a Bitcoin treasury company. Instead, he pointed to the company’s rising revenue and operating profit from Bitcoin-related activities, especially options income.

On Monday, Metaplanet said that its revenue for fiscal year 2025 was 8.9 billion Japanese yen (about $58 million), up nearly 738% from the previous year. However, the company also disclosed a net loss of around $680 million because the price of Bitcoin it owned fell sharply.

Gerovich added that using those non-cash losses as proof of strategy failure showed a lack of understanding of how to account for assets.

He said that Metaplanet set up a credit facility in October 2025 and then made additional drawdowns in November and December. These included details about the amounts borrowed, the collateral, the structure, and the general interest terms. All of this information can be seen on Metaplanet’s disclosures page.

Gerovich added that the lender’s name and particular terms were kept secret at the other party’s request.

Lastly, he said that the borrowing terms were good for Metaplanet and that the company’s balance sheet was still strong even though Bitcoin had dropped.

Treasury model under broader scrutiny

Gerovich’s defence comes at a time when other Bitcoin treasury plays are being closely looked at because their Bitcoin-heavy treasury model is risky and not very stable.

Strategy, the biggest company that owns BTC, said it lost $12.4 billion in the fourth quarter of 2025 because Bitcoin plummeted 22% during that time. However, it stressed that its financial structure was “stronger and more resilient” and that it had a “indefinite” Bitcoin time horizon.