South Korea’s Coinone is in talks for a stake sale with the country’s third-largest crypto exchange exploring options of selling part of its controlling shareholder’s stake.

Interestingly, crypto giant Coinbase is reportedly considering an equity stake in the exchange, positioning the move as a strategic counter to rival Binance’s investment in GOPAX.

According to local media reports from Sunday, Coinone is undertaking discussions for a stake in Chairman Cha Myung-hoon’s controlling 53.44% stake, held directly and through his firm, The One Group.

Parallely, Coinbase is set to visit South Korea this week to hold talks on a potential equity investment and broader cooperation with Coinone and other local partners.

The bidding talks come at a time when South Korea’s crypto M&A deals have skyrocketed as major foreign players eye shareholding in the nation’s rising crypto market.

Chairman Cha’s comeback raises Coinone ownership speculation

The deal speculations have intensified after chairman Cha Myung-hoon unexpectedly returned to active management just four months after stepping down as CEO.

Market watchers see the move as a possible step to stabilize operations and shape the company ahead of a stake sale or broader ownership change.

Coinone is currently controlled by chairman Cha Myung-hoon and his holding company, which together own 53.44% of the exchange, while gaming firm Com2uS holds a 38.42% stake.

Coinone’s poor financials fuel stake sale

The potential deal talks come after Coinone’s financial performance has consistently stayed below expectations, becoming a key factor in shaping valuation talks.

Continued losses have dragged down the exchange’s book value to about 75.2 billion won ($52 million) as of the end of the third quarter, according to Seoul Economic Daily.

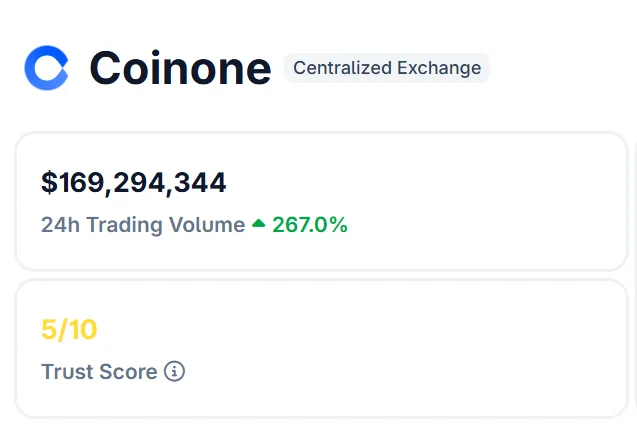

As South Korea’s third-largest crypto exchange by trading volume, Coinone has been seeking a buyer since late last year, with its weakened balance sheet likely strengthening a prospective investor’s negotiating position.

South Korea’s crypto exchanges see heightened demand from foreign players

The stake sale discussions come amid a broader consolidation wave sweeping South Korea’s crypto exchange industry, as traditional financial institutions and technology firms target licensed platforms with access to won-based trading.

Regulators recently approved Binance’s long-delayed acquisition of GOPAX, triggering renewed merger and acquisition activity across the sector.

Additionally, Naver Financial has agreed to acquire Dunamu, the operator of market-leading Upbit, in an all-stock transaction, while local media report Mirae Asset Securities is pursuing a stake in Korbit.

If completed, the deals would leave Bithumb as the only major independent exchange. Bithumb, the country’s second-largest platform by trading volume, has previously outlined plans for a New York Stock Exchange listing in the first half of 2026.