The rise of reserve-backed stablecoins such as Tether’s USDT and Circle’s USDC has transformed them from a crypto-native convenience into macro-relevant actors in global finance. Their reserves are overwhelmingly invested in short-term U.S. Treasuries, and at present scale well above $180 billion they rival sovereign investors. When new tokens are issued, billions of dollars are funneled rapidly into Treasury bills, pushing front-end yields lower. The reverse is not symmetrical: redemptions exert weaker upward pressure on yields because alternative buyers such as money market funds and the Federal Reserve’s overnight reverse repo facility absorb the slack. This asymmetry means that issuance produces sharper and more immediate effects than redemptions. The resulting yield compression eases financial conditions marginally, spilling into other markets. Crypto assets, especially Bitcoin and Ethereum, respond almost instantly with higher prices and volumes, while equities register smaller, slower-moving gains consistent with liquidity easing. Stablecoins have therefore become a new lever in global liquidity transmission, with asymmetric effects that link Treasury yields, crypto markets, and equity markets together.

The mechanics of stablecoin flows

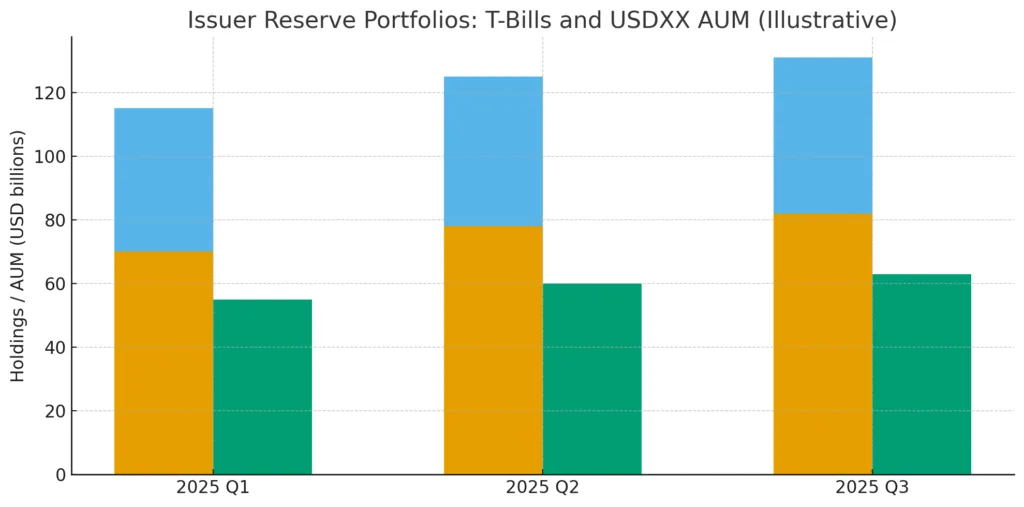

Stablecoins function as digital representations of fiat reserves, and their framework determines how transactions integrate into the conventional financial system. Whenever a new USDT or USDC token is generated, an equivalent dollar is added to the reserve portfolio of the issuer. These funds are primarily directed towards cash-equivalent assets and short-duration Treasuries. Tether’s reports indicate that its Treasury exposure is greater than $120–127 billion, whereas Circle’s USDC reserves are primarily held in the BlackRock USDXX government money market fund, which has over $63 billion in assets and focuses on bills with a maturity of less than one month. This scale has turned issuers into essential marginal purchasers of U.S. government debt.

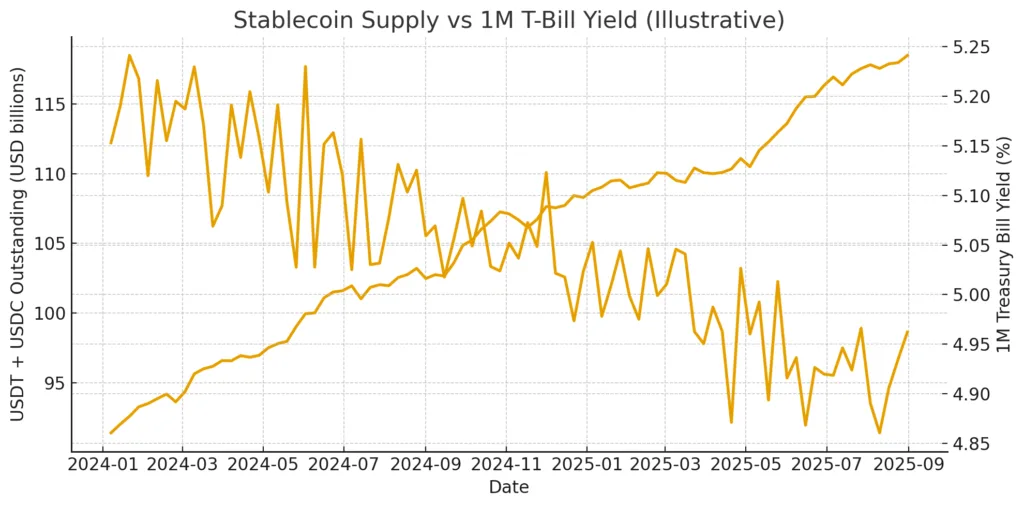

Issuance events are significant as the allocation of reserves occurs rapidly, channeling substantial amounts directly into the initial part of the curve. Even a small number of billion in concentrated buying can affect yields on one-month bills, particularly when overall supply is limited. In contrast, redemptions occur more slowly and are supported by money market funds and the Federal Reserve’s overnight reverse repo facility, serving as natural shock absorbers. This structural variation clarifies why inflows affect more strongly than outflows. The asymmetric pressure is not just a theory; it is evident in yield trends that correspond with the growth of stablecoin supply, and it intensifies when stablecoins represent a greater portion of bill demand.

The asymmetric effect on short-term treasury yields

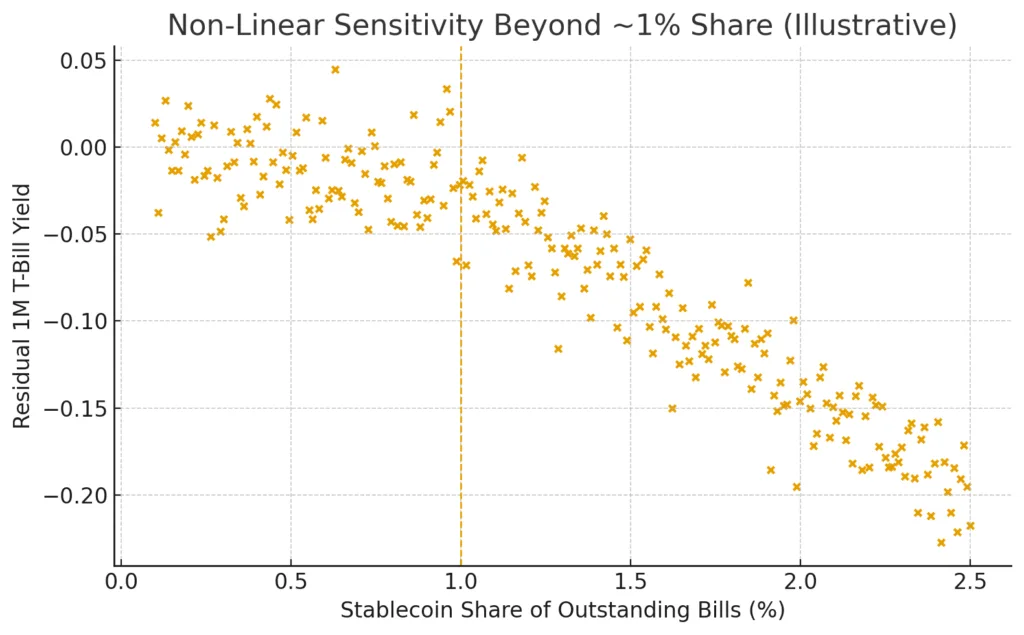

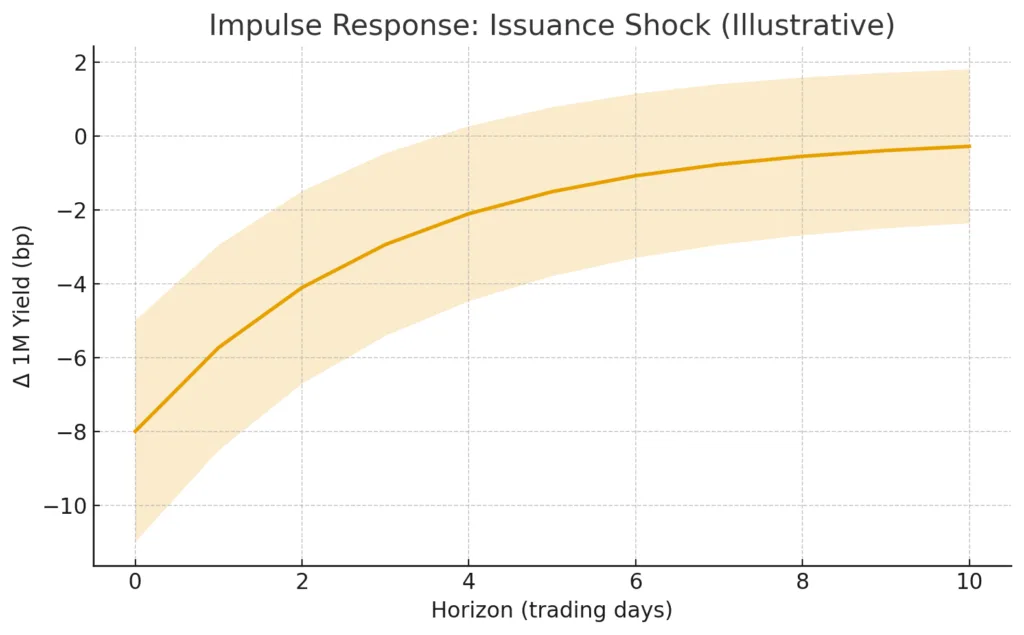

The unequal effect of stablecoin movements is most evident when observing the short end of the U.S. Treasury curve. The creation of new stablecoins leads to swift and concentrated demand for one-month and three-month bills, which are the primary instruments in issuer reserve portfolios. Academic research and BIS studies indicate that these inflows may reduce one-month yields by 14 to 24 basis points once the portion of bills owned by stablecoins exceeds a key threshold of approximately one percent. The effect is non-linear: at low market share levels, flows exert minimal influence, but after reaching a threshold, each added billion in demand results in an excessively large yield effect.

Redemptions reveal an alternate narrative. When stablecoins are destroyed and reserves converted to cash, the positive yield reaction is limited. This occurs because redemptions seldom take place in a single large block and because market structures mitigate the adjustment. Money market funds are prepared to take on selling, and the Federal Reserve’s overnight reverse repo facility offers a substantial pool of alternative liquidity options. Consequently, the absolute amount of yield compression at issuance is always more significant than the recovery at redemption. This imbalance illustrates not just portfolio dynamics but also institutional safeguards meant to stabilize front-end funding markets.

Spillovers to risk assets

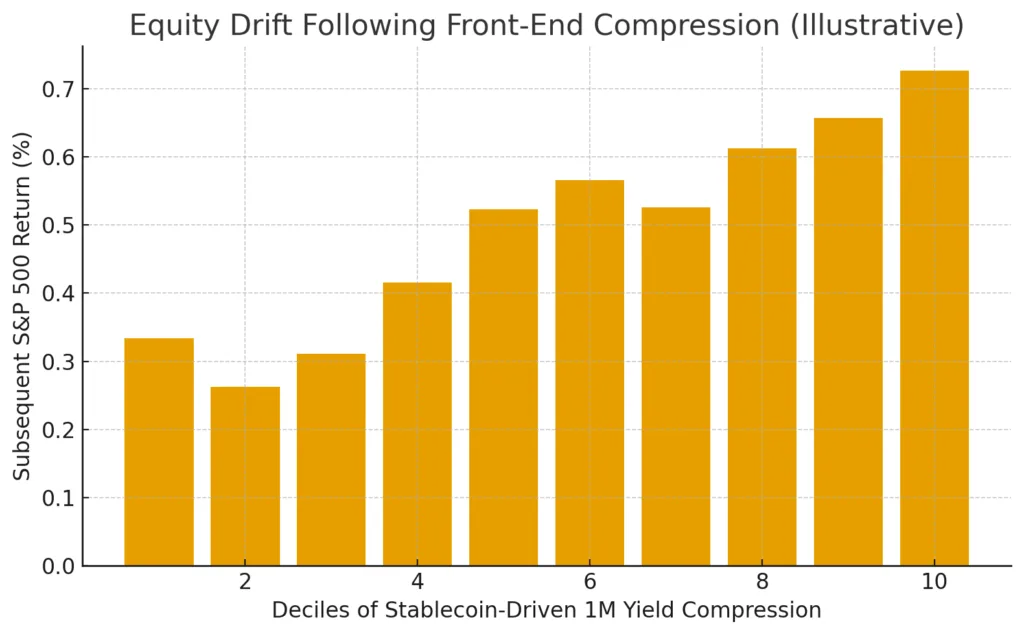

When stablecoin movements change the behavior of Treasury bills, the impacts reach wider risk markets via two separate channels. The initial is indirect and broad in scope. Decreased front-end yields indicate more favorable funding conditions and marginally relaxed liquidity, which consequently bolster risk appetite across various asset classes. Equity markets reflect this phenomenon gradually, with indexes like the S&P 500 or MSCI ACWI showing minor positive shifts one to three months following durations of robust stablecoin issuance. The connection is not predominant, as stocks are mainly influenced by earnings and macroeconomic forecasts, yet the liquidity effect can be seen at the margin.

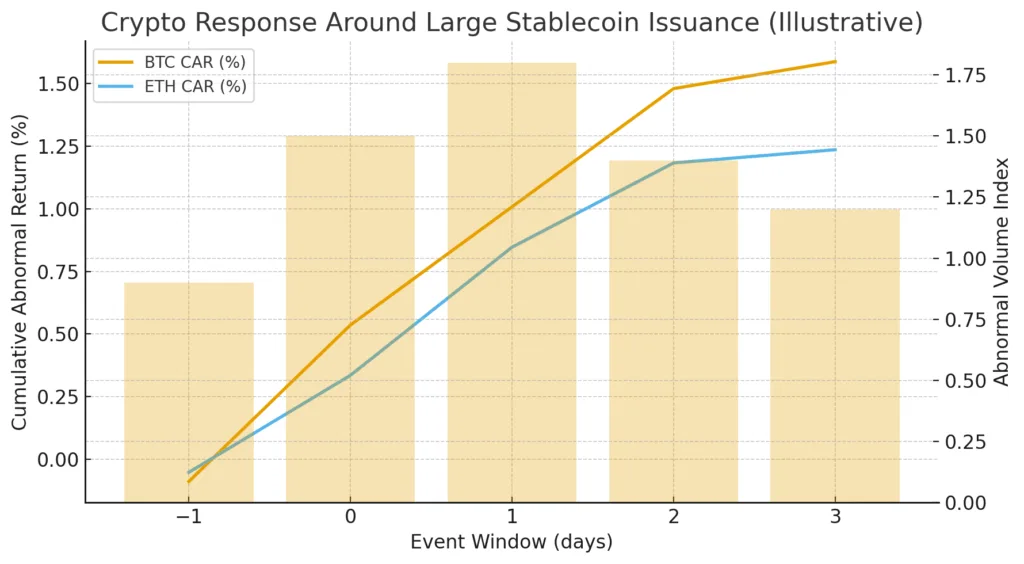

The alternative route is straightforward and significantly more noticeable in cryptocurrency markets. The issuance of stablecoins provides exchanges with immediate trading capital since the majority of digital asset transactions are conducted in stablecoins instead of dollars. Event studies consistently indicate that Bitcoin and Ethereum values increase in the days after significant minting events, accompanied by a surge in trading volumes during this period. The impact is instant since the new tokens function as new purchasing power, typically utilized within hours. This flow-driven dynamic indicates that crypto responds more significantly to issuance, while equities are influenced solely by the secondary liquidity channel. The spillovers therefore demonstrate the same asymmetry noted in the Treasury market, emphasizing the function of stablecoins as both liquidity sources and market influencers.

Research design and identification

To assess the asymmetric effects of stablecoin movements, the investigation should distinguish between positive issuance surges and negative redemption occurrences while relating them to Treasury yields and the performance of risk assets. The foundation is a daily panel that monitors changes in net stablecoin supply, one-month and three-month bill yields, Federal Reserve overnight reverse repo balances, Treasury auction volumes, and overall market indices. For cryptocurrency, Bitcoin and Ethereum returns and trading volumes align with the same timeline, enabling event windows during significant minting events.

The econometric framework utilizes local projection techniques to examine the impulse response of yields across periods spanning one to ten trading days. By separately defining inflows and outflows, the model identifies whether coefficients vary significantly in size, providing a straightforward assessment of asymmetry. Threshold regressions enhance this by detecting non-linear impacts when stablecoin holdings exceed a significant portion of the bill market. For spillovers, a two-step approach is suitable: initially calculate the fitted change in yields linked to stablecoin flows, then regress equity and crypto returns on this fitted impulse. To protect against endogeneity, one can use instruments derived from unpredictable crypto shocks, ensuring that the observed changes in stablecoin demand are exogenous rather than resulting from larger market cycles.

Case episodes and evidence

The uneven impact of stablecoin movements is most apparent when analyzed through recent instances where reserves increased or decreased dramatically. In early 2025, Tether announced Treasury holdings exceeding $120 billion, positioning it among the largest foreign official investors. Throughout this period, one-month bill yields consistently remained below fair value projections from Treasury models, as balances at the Federal Reserve’s overnight reverse repo facility decreased. The simultaneous growth of stablecoin supply alongside reduced front-end yields strongly indicates a causal link.

Circle’s USDC reserves provide another opportunity via the BlackRock USDXX fund, which had expanded to over $63 billion by September 2025, with an average maturity of merely seventeen days. This continual influx of new bills created a reliable and focused source of demand at the front end. Periods of swift fund expansion aligned with a decrease in one-month yields, bolstering the findings from Tether.

On the crypto side, event studies around large issuance days show immediate effects. Bitcoin often recorded statistically significant positive returns within two trading days of mints exceeding $100 million, accompanied by spikes in trading volume. These case studies highlight the direct liquidity injection mechanism and align with earlier findings that issuance is a short-term bullish catalyst. Equity markets reacted more subtly, but periods of sustained issuance often lined up with modest gains in equity indices, consistent with a liquidity spillover effect.

Robustness and caveats

Any effort to measure the uneven effects of stablecoin movements must confront possible biases and constraints. The primary issue is endogeneity. Bull markets in cryptocurrency not only draw in fresh stablecoin investments but also push asset prices up, raising the possibility that seen correlations might be misleading. To tackle this, identification strategies utilize instruments derived from unpredictable crypto shocks, guaranteeing that the changes in flows are exogenous rather than merely reflecting increased demand.

An additional concern is the makeup of reserves. Issuers occasionally modify allocations among cash, bank deposits, and Treasuries, impacting the effective maturity and responsiveness of their portfolios. Recreating daily or weekly reserve profiles from disclosures is essential to account for this detail. In a similar manner, depending on attestations instead of comprehensive audits results in asset holdings being reported with reduced detail and validation, which creates uncertainty regarding the precise quantity and composition of assets.

Ultimately, policy and market configuration can limit the reach of stablecoin impact. The Treasury’s issuance approach dictates the availability of bills, whereas the Federal Reserve’s tools like the overnight reverse repo program establish a lower and upper limit for front-end rates. These institutional elements keep yields from straying too far from fundamentals, even with robust stablecoin demand. Consequently, assessed impacts ought to be viewed as significant yet limited within the larger framework of U.S. money markets.

Implications for market participants

The results regarding asymmetry in stablecoin movements have specific consequences for various segments of the market. For rate traders, the issuance of stablecoins should now be considered another source of demand influence on the bill curve. Substantial weekly or monthly minting can skew bills in favor of swaps or longer-term Treasuries, generating chances or threats in relative value strategies. Redemption waves, conversely, pose a lower risk to front-end yields as they are protected by structural buffers, which means the asymmetry lessens the likelihood of abrupt increases in funding expenses.

For equity investors, the impact is more complex but still important. Front-end compression influences financial condition indicators, providing a modest uplift to overall markets. This should not be mistaken for a primary determinant of equity returns, which remain connected to earnings and economic predictions, but it may serve as an auxiliary confirmation signal in periods of liquidity uncertainty.

For participants in cryptocurrency, the effects are the most urgent. Stablecoins issued beyond a certain threshold serve as immediate bullish triggers, as they inject new capital into trading and are interpreted by market actors as indicators of demand. Tracking issuance data in real time can thus guide tactical positioning. Collectively, these impacts illustrate that stablecoins serve as a link between digital liquidity and conventional market frameworks, making it essential to monitor their movements across various asset classes.

Conclusion

Stablecoins have transitioned from specialized settlement instruments in cryptocurrency markets to integral players in worldwide liquidity. Their reserve holdings, primarily consisting of short-term U.S. Treasuries, are currently substantial enough to impact front-end yields in significant ways. The data consistently indicates that issuance reduces one-month bill yields much more significantly than redemptions increase them, highlighting a notable asymmetry based on market dynamics and institutional safeguards. This compression slightly alleviates financial conditions, producing immediate and significant effects in crypto markets while having a longer but still noticeable impact on equities.

The wider implication is that stablecoin movements have emerged as a new factor in the global financial landscape. They associate crypto sentiment with Treasury market trends and, via liquidity pathways, with the risk appetite in conventional assets. With the expansion of stablecoins, their impact on funding markets and inter-asset correlations will also increase. For traders, investors, and policymakers, stablecoins have transitioned from being peripheral to becoming a fundamental force that influences how liquidity is generated, moved, and absorbed throughout markets. Grasping their uneven influence is crucial for analyzing front-end rates, overseeing portfolio risk, and predicting moments of liquidity pressure or ease.