Throughout a significant part of its history, the crypto sector has prospered not through balance sheets, cash flows, or profits, but through compelling stories. Bitcoin was celebrated as “digital gold,” a safeguard against inflation and a revolt against the fiat currency system. Ethereum was touted as the “global computer,” able to support a novel decentralized internet where applications operated beyond the influence of governments and corporations. Countless other tokens capitalized on these assurances, each promoting itself as the entry point to an innovative new future.

In this period of enthusiasm, valuations were disconnected from conventional financial fundamentals. Tokens soared due to whitepapers, memes, celebrity support, and the fear of being left out. Venture capital firms invested billions into initiatives that frequently possessed little beyond a concept and a plan. Retail investors, keen to catch the “next Bitcoin,” embraced inflated valuations as the new standard. At its highest point, the cryptocurrency market surpassed $3 trillion in total market cap, even though numerous assets had no revenue sources or viable economic frameworks.

Yet, excitement by itself is never sufficient to maintain valuations indefinitely. With the industry’s evolution, institutional investors have joined, bringing expectations shaped by years of experience in equity markets. Pension funds, asset managers, and sovereign wealth funds are not swayed by mere hype. They demand quantifiable essentials: earnings, sales, customer expansion, and evidence of lasting value generation. This change in investor profile is compelling the market to face unsettling realities.

Concurrently, authorities are intensifying their control. The period of unrestricted token launches in the laissez-faire era has ended. Securities regulators across the United States and European Union are progressively requiring tokens to demonstrate their utility, or they may face classification as securities that are bound by financial disclosure regulations. Simultaneously, accounting firms and data platforms are creating tools to assess protocol earnings, staking rewards, and network charges.

The alignment of investor sophistication, regulatory oversight, and clear on-chain information has resulted in a pivotal moment for cryptocurrency. Similar to the shift from the early internet’s “dream valuations” to a focus on price-to-earnings ratios, the crypto industry is being urged to mature. The question has shifted from What might this token be valued at in the future? to What is the current earning of this token today.

The enthusiasm for crypto is not finished, but it is evolving. Rather than being appreciated solely for their aspirations, the industry is transitioning into a new era where cash flows, on-chain income, and measurable fundamentals will play a growing role in deciding which projects thrive and which vanish over time.

The dot-com parallel

Financial history seldom repeats in the same way, but it frequently echoes. To grasp the future of crypto, one need only look back to the late 1990s, a period marked by the rise and fall of the dot-com bubble. In that period, investors were fascinated by the revolutionary possibilities of the internet. Businesses that possess just a website and an appealing domain name can achieve valuations in the billions. The prevailing mantra was “grow rapidly,” and profitability was regarded as nearly unimportant in comparison to the potential of seizing market share in a burgeoning digital economy.

When the bubble collapsed in 2000, trillions of dollars in paper assets disappeared. Many dot-com firms failed, resulting in vacant offices and deserted websites. From that debris arose the giants of contemporary technology: Amazon, Google, eBay. These companies endured not due to superior storytelling, but because they ultimately produced genuine revenue streams, established scalable frameworks, and developed sustainable business models. They shifted from values based on hype to price-to-earnings ratios that represented their financial success.

Cryptocurrency is currently experiencing its own dot-com era. During the mid-2010s, Initial Coin Offerings (ICOs) enabled projects to collect substantial amounts with merely a PDF and a Telegram group. During the 2020–2021 bull cycle, decentralized finance (DeFi) protocols offered extremely high returns without any viable sustainability mechanisms. NFT ventures surged into multi-billion-dollar markets, only to implode when speculative enthusiasm waned. Similar to pets.com during the dot-com boom, numerous ventures turned into cautionary examples of enthusiasm without implementation.

However, similar to the internet revolution, a small number of survivors are starting to demonstrate their strength. Prominent exchanges like Coinbase and Binance disclose billions in yearly earnings. Ethereum, after the merge, produces steady fee revenue and allocates staking rewards similar to dividends. Decentralized exchanges such as Uniswap and Curve are establishing strong barriers in liquidity provision. These are the companies and protocols that will evolve into Amazons and Googles, becoming more robust as valuations transition from hype to earnings.

The dot-com analogy offers investors a guide. Following the bubble collapse, the market took years to adjust company valuations according to actual metrics: revenue, profit, and user expansion. Currently, cryptocurrency is undergoing a similar transformation. Projects lacking authentic economic value will be rejected, whereas those with strong fundamentals will draw interest from both institutional and retail investors.

The vibrancy of the last ten years won’t completely disappear; markets consistently require positivity to drive creativity, but the speculative excitement will transition to a more restrained period. Similar to how the internet transformed the world, cryptocurrency will persist beyond its current hype. The distinction lies in the fact that future valuations will be based on quantifiable, lasting earnings.

The rise of on-chain earnings metrics

Conventional equity markets have historically relied on financial statements, quarterly earnings calls, and audited reports to evaluate company performance. Investors depend on indicators like price-to-earnings ratios, EBITDA multiples, and discounted cash flow models to assess business value. In cryptocurrency, these tools were initially missing. The majority of projects provided no verified revenue reports, no profit-and-loss statements, and no forecasts for future outcomes. Valuation was subject to conjecture, promotion, and trend fluctuations.

However, blockchains possess a revolutionary answer to this issue: transparency. Each transaction, all fees, and every token creation is logged on-chain, available instantly. This unparalleled transparency has led to the emergence of a novel category of earnings metrics derived directly from blockchain information. Investors can now track revenue flows daily, even hourly, across key networks and protocols rather than waiting for quarterly reports.

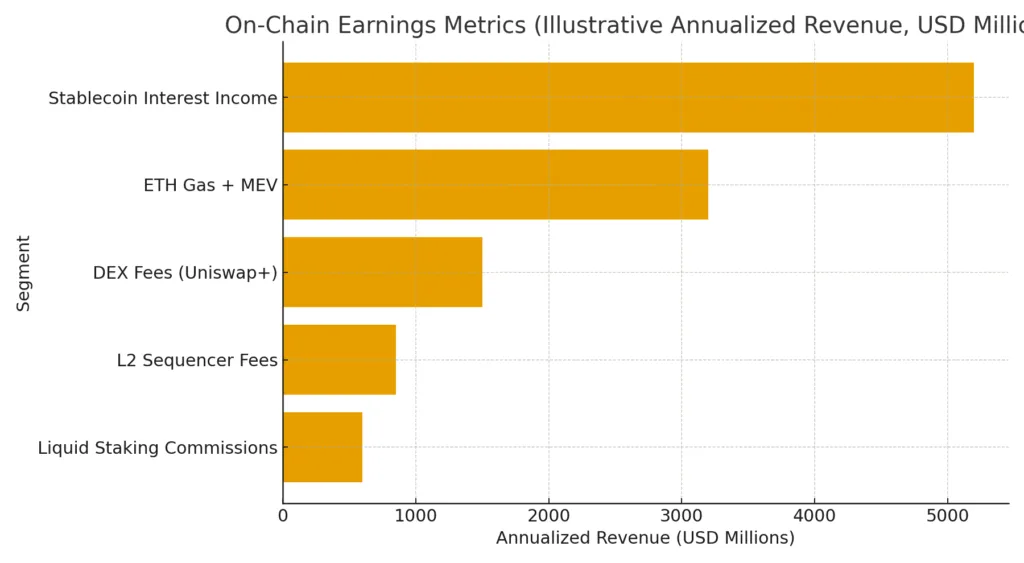

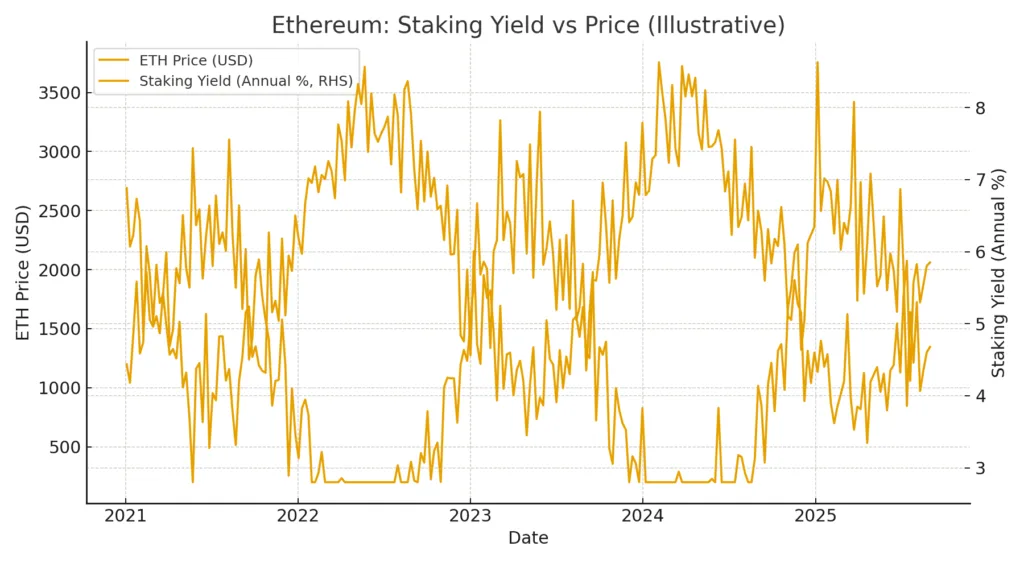

Ethereum’s move to proof-of-stake demonstrates this change. After “the Merge,” Ethereum turned into a yield-generating asset. Validators receive staking rewards from transaction fees and maximal extractable value (MEV), generating a measurable income stream similar to dividends in stock markets. Analysts currently monitor Ethereum’s yearly staking yields, gas fee income, and net issuance, contrasting these with its market cap to create valuation ratios.

Layer-2 scaling solutions are utilizing comparable frameworks. For instance, Optimism and Arbitrum generate sequencer fees from transactions that are handled off-chain yet finalized on Ethereum. These revenues can be seen, enabling analysts to determine gross margins and growth rates for newly established networks.

Decentralized exchanges (DEXs) also demonstrate the strength of on-chain metrics. Platforms such as Uniswap earn fees from trading, which are allocated to liquidity providers. Token Terminal and Dune Analytics now compile this information, allowing investors to assess protocol revenues in relation to token valuations almost instantly. Consequently, investors are able to determine if a DEX token is valued at a sensible multiple of its fee revenue or at an exaggerated valuation driven solely by speculation.

Issuers of stablecoins have emerged as another example of transparency in earnings. Circle and Tether earn billions each year from the interest on their reserves, mainly in U.S. Treasuries. Although not all of this income is recorded on-chain, disclosures and external reports emphasize the profitability of the business model. For the first time, the valuations of stablecoins can be linked to reliable cash flows, establishing a basis for multiples reminiscent of price-to-earnings.

What arises from these instances is a financial environment where crypto can no longer conceal itself behind obscurity. The information is present, awaiting interpretation. Investors using dashboards, APIs, and analytical tools can compare tokens to revenue streams, similar to how they do with stocks.

This development indicates the growth of cryptocurrency. Excitement is yielding to quantifiable results. Profits are no longer vague or concealed; they are embedded in the very systems that investors aim to assess. For cryptocurrencies, the era of digits has started.

The new investment playbook

The transition from speculative enthusiasm to earnings-driven valuation not only changes the criteria for evaluating protocols but also compels investors to revise their strategies. For years, achieving success in crypto involved recognizing trends early: the “Ethereum competitor,” the “DeFi transformation,” the “NFT surge.” Traders who identified trends early, often via social media buzz or meme energy, could significantly grow their portfolios within weeks. Principles were insignificant in comparison to timing and emotion.

That period is declining. With institutional capital playing an increasing role in the market, the criteria for assessment are aligning more closely with those of conventional finance. Investors are starting to pose common inquiries: What is the revenue strategy? To what extent are the profits sustainable? What share of cash flows, if any, goes to token holders? Are expenses controllable, or is the protocol reliant on inflation-based support? These are not theoretical activities; they are the metrics that will increasingly dictate survival.

The strategy for investment is moving towards methods such as discounted cash flow analysis and revenue multiples. Ethereum, for example, is currently evaluated by forecasting the growth of transaction fees, staking returns, and the influence of scaling solutions on potential profits. Instead of considering ETH solely as a speculative asset, certain investors perceive it in the same way they would approach a high-growth tech stock.

This shift also compels portfolio diversification strategies to change. Investing capital according to hype cycles is fundamentally unstable, as demonstrated by the failures of Terra, Celsius, and FTX. In contrast, a fundamentals-based strategy promotes diversification among revenue-generating sectors: exchanges, infrastructure providers, stablecoin issuers, and staking services. Each of these mirrors a conventional industry sector, featuring quantifiable cash flows and distinct competitive strengths.

Regulation introduces an additional dimension. As initiatives embrace revenue-sharing frameworks, the case for classifying tokens as securities becomes more compelling. Although this raises compliance demands, it simultaneously boosts legitimacy. For major investors who were once concerned about ambiguous regulatory conditions, the move toward earnings-driven frameworks may ultimately validate long-term investment.

For retail investors, the takeaway is straightforward: the era of pursuing hype is coming to a close. The victors in the upcoming cycle won’t necessarily be the noisiest or most viral tokens, but those that can demonstrate financial resilience. The cryptocurrency investment strategy is shifting away from speculation towards fundamental analysis.

The end of exuberance

The tale of cryptocurrency is fundamentally a tale of development. It started as a trial at the outskirts of the internet, an open-source initiative overlooked by conventional finance as insignificant. It evolved into a worldwide phenomenon, featuring trillions in market capitalization, millions of users, and entire industries constructed upon blockchains. Yet, akin to all groundbreaking technologies, it now confronts the tough challenge of credibility: can it transcend aspirations and rest on the basis of quantifiable worth.

The conclusion of euphoria is not a demise for crypto. In fact, it signifies the onset of maturity. Similar to how the dot-com crash eliminated unviable businesses and enabled genuine innovators to thrive, the movement toward price-to-earnings valuation will distinguish between valuable insights and distractions. Protocols that can maintain genuine revenue through transaction fees, staking rewards, or infrastructure services will persist, whereas empty projects will fade into the annals of history.

This new age also makes accountability more democratic. In contrast to conventional markets, where retail investors rely on quarterly reports and insider information, the transparency of crypto’s on-chain data provides unmatched clarity. Anyone possessing the tools and expertise can evaluate a protocol’s cash flows instantaneously. This opens doors not only for advanced institutional investors but also for retail investors ready to go past excitement and adopt data-focused tactics.

Certainly, the shift will not be seamless. Numerous projects continue to depend significantly on inflationary tokenomics and commitments of future usefulness. Some will oppose the move to fundamentals, claiming that crypto is too distinctive to be evaluated by conventional criteria. However, historical evidence indicates that markets consistently revert to quantifiable standards. When stakes rise significantly, investors, regulators, and users all seek accountability.

The protocols that simultaneously adopt transparency, sustainability, and innovation will be the victors of the price-to-earnings age. They will uphold the visionary spirit of crypto while ensuring it aligns with genuine financial results. Ethereum’s proof-of-stake model, resilient decentralized exchanges with sustainable fee frameworks, and stablecoin issuers overseeing billions in assets represent initial instances of this equilibrium.

The protocols that simultaneously adopt transparency, sustainability, and innovation will be the victors of the price-to-earnings age. They will uphold the visionary spirit of crypto while ensuring it aligns with genuine financial results. Ethereum’s proof-of-stake model, resilient decentralized exchanges with sustainable fee frameworks, and stablecoin issuers overseeing billions in assets represent initial instances of this equilibrium.