- Trump to sign executive order investigating debanking of crypto firms and conservatives, a Wall Street Journal report suggests.

- The order targets regulatory policies and calls for a review of SBA-backed loan practices.

- “Operation Choke Point 2.0” resurfaces as a key accusation in the crypto space.

Former President Donald Trump is reportedly preparing to sign an executive order that would direct U.S. banking regulators to investigate claims of “debanking” against crypto firms and political conservatives. According to a draft order seen by The Wall Street Journal, the directive could be signed as early as this week, though White House insiders note that the timeline remains subject to change.

The executive order seeks to address longstanding concerns from the digital asset industry and right-leaning political figures who say they have been systematically excluded from the financial system under regulatory pressure. The draft order would require banking regulators to examine whether any financial institutions violated antitrust, consumer protection, or fair lending laws by cutting off services to certain sectors or individuals.

Regulatory overhaul in sight

If signed, the order would instruct regulators to roll back internal policies that may have contributed to discriminatory account closures, particularly targeting crypto businesses. It also includes provisions to review how the U.S. Small Business Administration guarantees loans for affected clients. Any confirmed violations may be referred to the Department of Justice, escalating the matter to the attorney general for further action.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

This move comes after months of mounting claims that regulatory bodies under the Biden administration indirectly pressured banks to sever relationships with crypto firms following the FTX collapse. The resulting scrutiny allegedly discouraged many institutions from maintaining ties with the digital asset sector, even when no legal wrongdoing was present.

Industry leaders have likened the situation to a modern version of the controversial “Operation Choke Point,” a program from the 2010s where regulators pressured banks to stop servicing industries deemed high-risk. Nic Carter, a crypto venture capitalist, coined the term “Operation Choke Point 2.0” to describe what many in the sector believe to be targeted enforcement against crypto platforms.

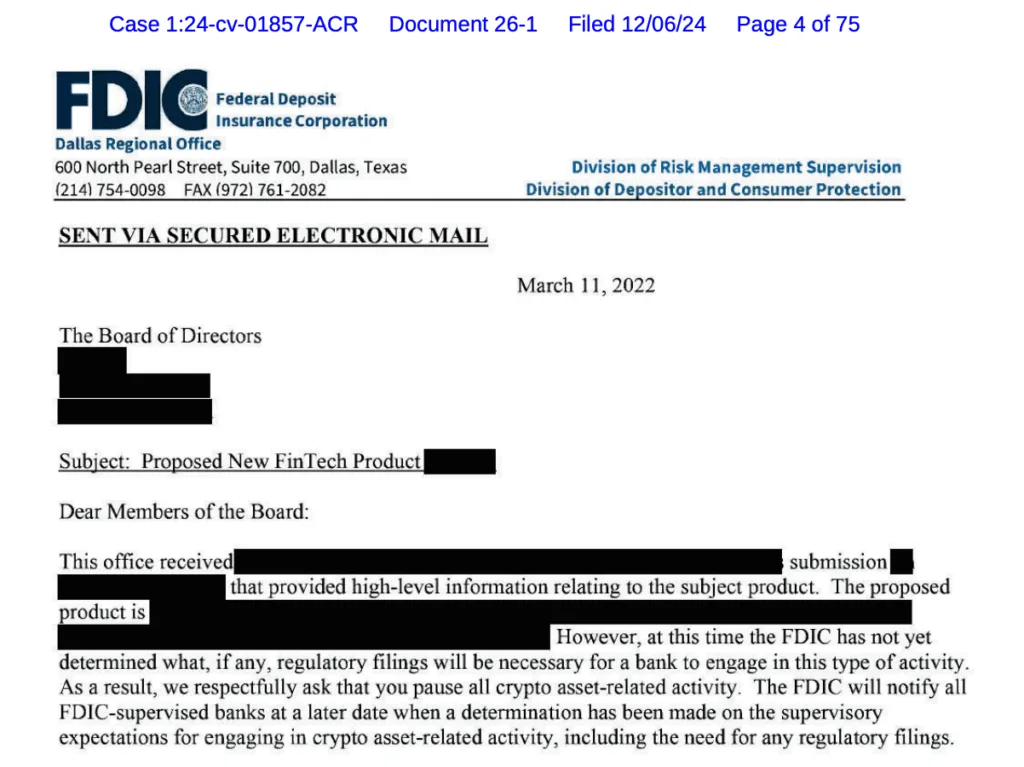

Coinbase’s chief legal officer, Paul Grewal, previously testified before Congress that the FDIC pressured banks into distancing themselves from digital assets, using intense scrutiny and examination tactics. Grewal cited internal documents revealed through a Freedom of Information Act lawsuit showing that the Federal Deposit Insurance Corporation (FDIC) had asked financial institutions to pause crypto-related banking activities. These findings, according to Grewal, debunked the notion that the crypto industry’s concerns were based on conspiracy or speculation.

Conservatives allege political bias in account closures

The draft order also expands its scope to investigate the so-called “debanking” of political conservatives. It criticizes financial institutions that allegedly cooperated with federal investigations into the January 6 Capitol riots and hints that some individuals or organizations may have been denied banking services based solely on political affiliation.

While banks argue that such decisions are part of a broader risk mitigation process known as “derisking,” the order challenges whether political beliefs should be considered valid grounds for account termination. The Federal Reserve recently announced it would stop examining for reputational risk a shift already made by both the Office of the Comptroller of the Currency and the FDIC signaling growing acknowledgment of the controversy.

Rita Dfouni

Rita Dfouni