A recent FinCEN advisory has disclosed that US banks handled $312 billion in illegal funds from Chinese money laundering networks from 2020 to 2024, supporting activities associated with Mexican drug cartels, real estate scams, and human trafficking

The watchdog revealed that more than 137,000 Bank Secrecy Act reports were examined, indicating that an average of $62 billion was laundered annually through US institutions. Cartels utilized these funds to clean drug earnings, while Chinese gangs obtained US dollars to bypass China’s strict capital restrictions.

FinCEN Director Andrea Gacki highlighted the extent of the issue: “These networks facilitate money laundering for cartels based in Mexico and function as clandestine financial systems globally.” Apart from drugs, networks funneled $53.7 billion via dubious real estate transactions and were involved in healthcare fraud and elder exploitation.

Crypto Still Takes the Heat

Regardless of these statistics, legislators persist in focusing on cryptocurrency as a main method for laundering. Senator Elizabeth Warren has consistently urged for stricter cryptocurrency regulations, cautioning: “Malicious individuals are more frequently using cryptocurrency to facilitate money laundering.”

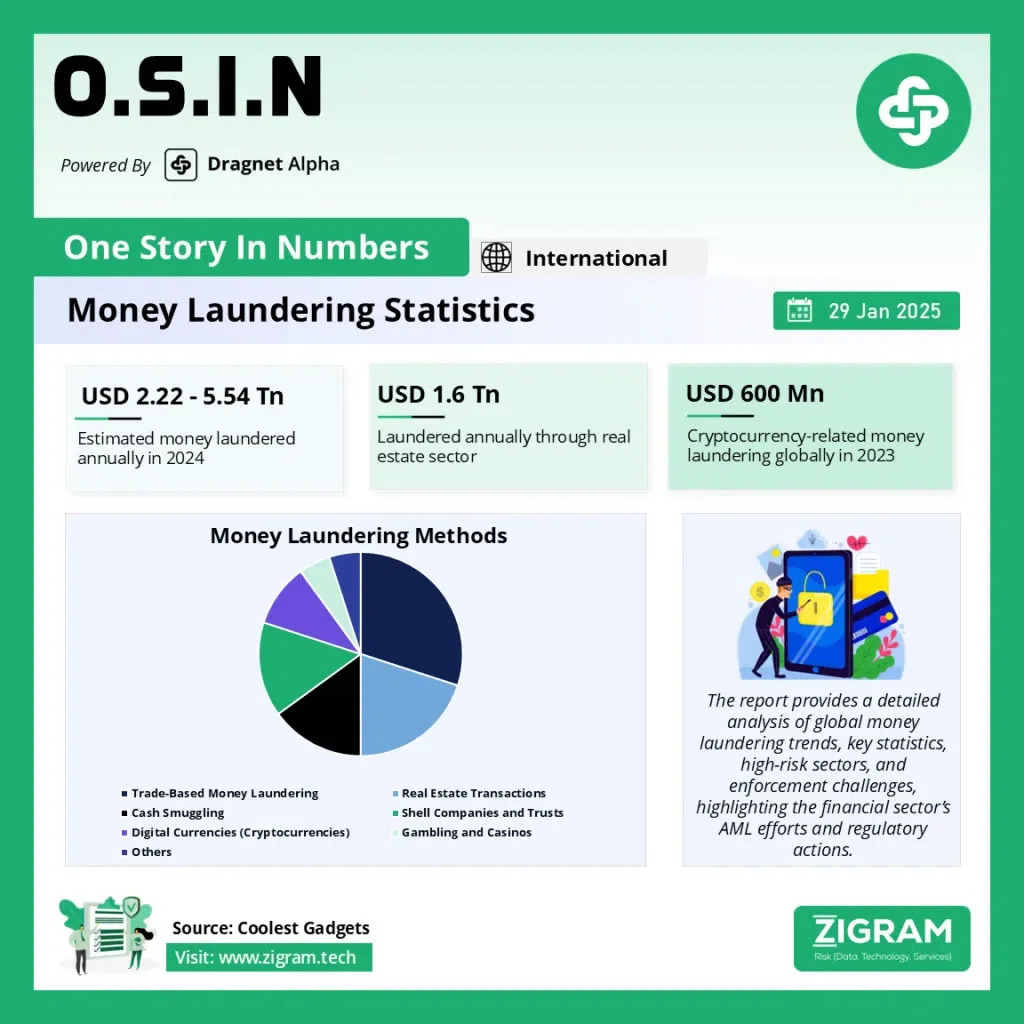

However, the information indicates an alternative narrative. The United Nations Office on Drugs and Crime reported that worldwide money laundering surpassed $2 trillion in 2024, primarily involving banks, cash smuggling, and real estate. In contrast, laundering related to cryptocurrencies was approximately $600 million in 2023, with the total illicit cryptocurrency volume reaching only $189 billion over a period of five years as reported by Chainalysis.

Industry experts stress that crypto represents a tiny fraction of laundering activity. TRM Labs’ Angela Ang stated: “Illicit activity accounts for less than 1% of crypto transactions. FinCEN’s findings confirm that banks and underground fiat systems remain the real engines of laundering.”

Source: Zigram

The amount laundered with crypto is minuscule compared to money laundering involving cash and banks.