The U.S. CLARITY Act has taken a centre stage again as the SEC’s Crypto Task Force added two new submissions to its “Written Input” page on Tuesday.

The additions highlight important issues in crypto regulation including self-custody and deFi oversight.

The initial proposal, submitted by “DK Willard,” is concerned with safeguarding the self-custody rights of the retail participants in Louisiana, emphasizing the need for better-defined safeguards for persons who are in control of their own digital property.

The second, from the Blockchain Association Trading Firm Working Group, looks at how proprietary trading in tokenized and DeFi markets should be regulated, including dealer rules for tokenized equities.

Together, the submissions show growing industry interest in ensuring both user protections and fair trading standards as crypto markets continue to evolve.

SEC’s new submissions come as White House contemplates CLARITY Act nitty-gritty

The submissions come as Congress continues negotiating the federal crypto market bill, CLARITY.

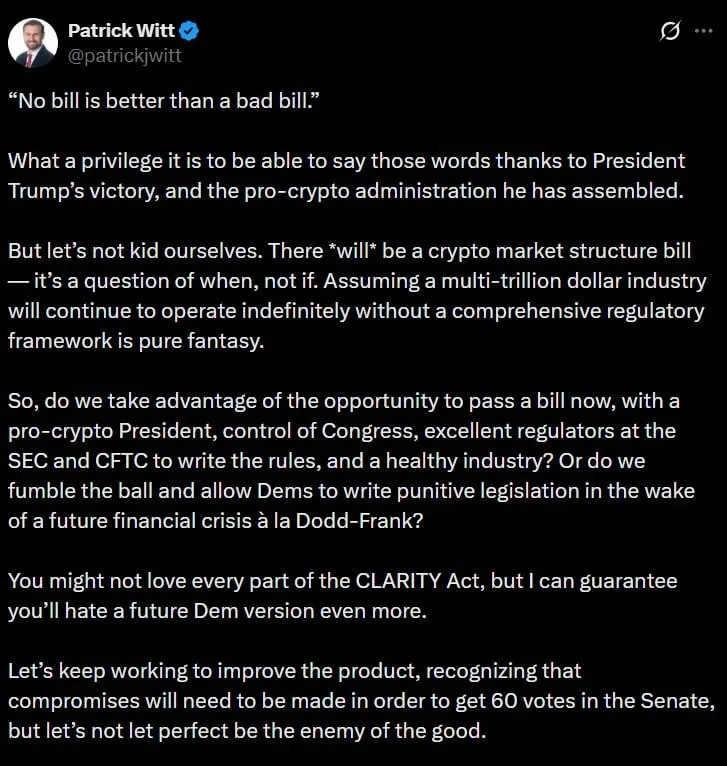

Senior White House crypto adviser Patrick Witt has urged the industry to accept the changes to help the act pass while Republicans control Congress and the Trump administration remains in power.

Lawmakers and industry players are trying to strike a balance between key issues like stablecoin yields, DeFi liquidity, and investor protections.

The submissions show how stakeholders are weighing in, aiming to shape a regulatory framework that allows innovation to thrive while keeping consumers safe and the crypto market transparent and stable.

Besides rallying support for the CLARITY ACT, White House crypto adviser Patrick Witt also spoke out against Coinbase’s withdrawal from the market structure bill, advising that further delay would only invite more severe regulation.

The counsel emphasised the necessity of participating in legislative processes to develop favourable legislation. The development demonstrates the persistent conflicts between bitcoin platforms and regulatory authorities as they negotiate the changing legal landscape.

The worldly battle follows floating rumours of White House considering the withdrawal of support for the CLARITY Act unless Coinbase returned with a “yield agreement” acceptable to banks.

An anonymous source close to President Trump reportedly confirmed the development, highlighting stalled negotiations and the need for a deal to move the legislation forward.

Why did Coinbase oppose the CLARITY Act structure?

Coinbase has been one of the most stringent opposers of the current proposed CLARITY Act structure.

The exchange thinks that by limiting the way blockchain-based shares and financial products can be used on the infrastructure of cryptocurrencies, the proposal effectively limits the use of tokenized stocks.

Second, the plan increases the availability of data on financial transactions in a decentralized manner to the government. Third, the Securities and Exchange Commission has greater control over the cryptocurrency market under the revised version.

CLARITY ACT status quo: what is happening?

The Crypto Market Structure Bill sees the SEC and CFTC as key players in regulating the U.S. crypto market. The bill seeks to offer clarity in the crypto industry by filling a gap in regulation.

It will clarify the classification of digital assets, specify the scope of intermediary regulation, and establish stringent consumer protection measures.

The bill for the law is yet to undergo a markup by both the Senate Banking and Agriculture committee.

Following Coinbase’s rejection of the draft laws, the Senate Banking Committee postponed its markup session on the bill, during which regulators would have reviewed the bill and recommended amendments if required. The next date for the Banking Committee’s markup of the CLARITY Act has yet to be announced.

However, the Senate Agriculture Committee plans to have the markup hearing on January 27.

While the Senate Agriculture Committee oversees the Commodity Futures Trading Commission (CFTC), the Senate Banking Committee determines SEC rules.

The dual control makes the approval from both committees an essential requirement to develop a legal framework that is compatible with CFTC and SEC laws while also meeting industry expectations.

Meanwhile, the crypto world appears divided on the law, making the bill and its discussion a high priority market event.