The US government has entered its third week of shutdown, with the Senate preparing to vote Monday evening in an attempt to reopen federal operations. The 5:30 p.m. ET vote marks the 11th effort to break the funding impasse that began on October 1.

If approved and signed by the President the measure would end one of the longest government shutdowns in US history, trailing only those of 1995 and 2018–2019. Another failed vote would extend the deadlock, keeping key agencies closed or under limited operation.

Despite the budget standoff, lawmakers continue to move forward on other legislative matters, including long-stalled digital asset regulations.

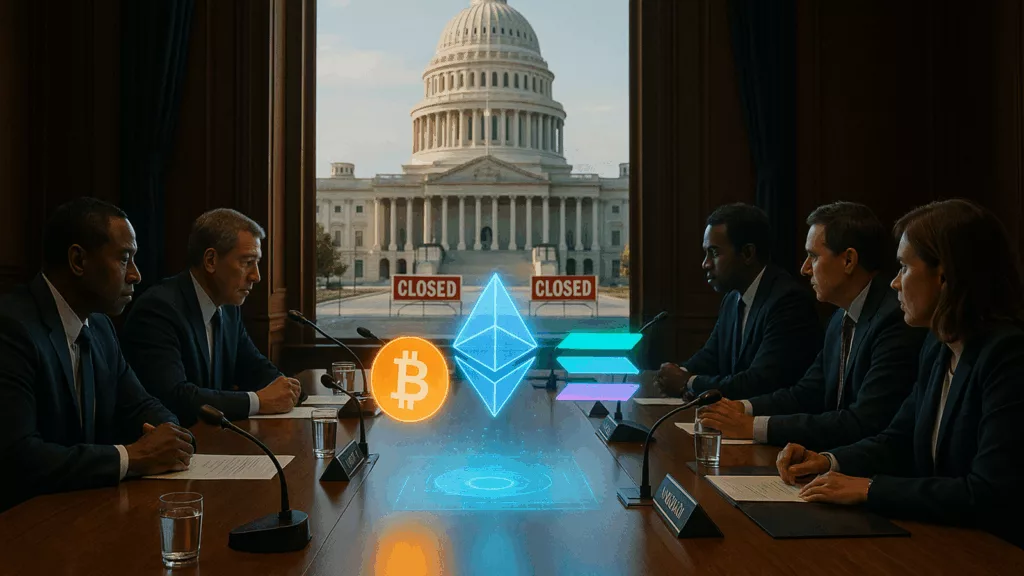

Lawmakers and crypto leaders to discuss market structure bill

On Wednesday, Senate Democrats will host a roundtable discussion with leaders from major crypto firms, including Coinbase, Kraken, Circle, and Ripple, according to journalist Eleanor Terret in a post on X.

The meeting will be led by Senator Kirsten Gillibrand and is expected to focus on the US crypto market structure bill, which aims to establish a unified federal framework for digital assets. The legislation mirrors the CLARITY Act, a bipartisan bill passed by the House of Representatives in July.

Gillibrand’s session comes shortly after several Democratic senators introduced a counter-proposal that critics claim would undermine decentralized finance (DeFi) and weaken cross-party consensus achieved in the House.

While progress on the Senate version of the bill has been slow, the renewed engagement with industry leaders signals a potential breakthrough in shaping the United States’ digital asset policy.

ETF approvals stall amid SEC shutdown slowdown

The government shutdown has also affected progress on cryptocurrency exchange-traded funds (ETFs), as the Securities and Exchange Commission (SEC) operates with a skeleton staff.

October was expected to be a crucial month for US crypto ETFs, but the SEC’s limited capacity has delayed key filings and approvals. The first missed deadline involved Canary Capital’s proposed Litecoin ETF on October 2, followed by its HBAR ETF shortly after.

According to Bloomberg analyst Eric Balchunas, both ETFs appear to have been finalized but remain pending due to the ongoing shutdown.

Several proposals, including those from Bitwise, Fidelity, Franklin Templeton, CoinShares, Grayscale, Canary Capital, and VanEck, also feature staking components for Solana and Ethereum ETFs, reflecting the growing appetite for yield-based products in regulated markets.