US-listed Bitcoin ETFs brought in $355 million, ending a seven-day streak of withdrawals that totalled $1.12 billion.

US spot Bitcoin exchange-traded funds (ETFs) reversed a seven-day streak of net outflows, bringing in $355 million as traders saw early signs that global liquidity was becoming better.

According to SoSoValue, the iShares Bitcoin Trust ETF (IBIT) from BlackRock topped the way with $143.75 million in inflows on Tuesday. It was followed by the Ark 21Shares Bitcoin ETF (ARKB) with $109.56 million and Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $78.59 million. Bitwise’s Bitcoin ETF (BITB) brought in $13.87 million, while Grayscale’s Bitcoin Trust ETF (GBTC) brought in $4.28 million and VanEck’s Bitcoin ETF (HODL) brought in $4.98 million.

The change happened after spot Bitcoin (BTC) $88,858 ETFs saw a total of $1.12 billion in net withdrawals during the last seven trading days. Funds were sold the most on Friday, when they lost around $275.9 million.

In December, the most significant factor was the outflows, as spot Bitcoin ETFs lost a total of $744 million due to investors withdrawing funds in response to falling prices and limited liquidity at the end of the year.

Improving global liquidity drives renewed optimism

The change in flows happens when liquidity conditions get better. Arthur Hayes wrote on X on Wednesday that global dollar liquidity probably hit its lowest point in November and has been slowly rising since then. Hayes added, “The $liquidity likely bottomed in November and is slowly rising.” He also said that the setup favours a new push in the crypto markets.

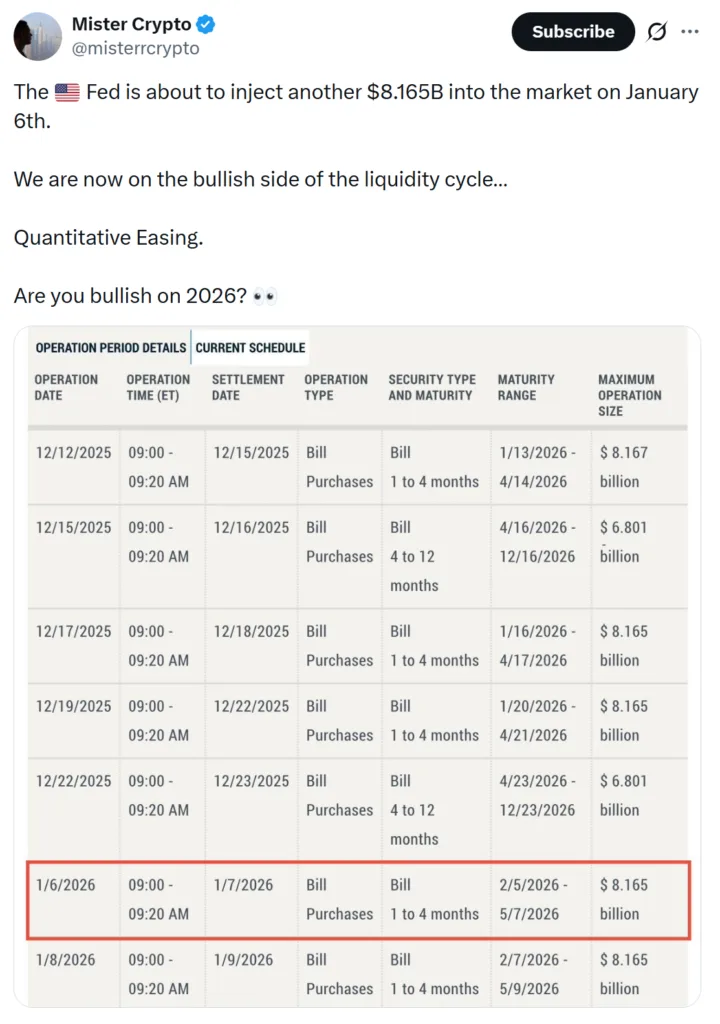

Other experts agreed with this point of view. Mister Crypto, a crypto analyst, said that global liquidity indicators were “going vertical,” which means that measures of the money supply were moving up in major economies.

The analyst also talked about how the Federal Reserve will soon buy US Treasury bills. He said that the Fed will put $8.165 billion into the markets on Tuesday. He remarked, “We are now on the bullish side of the liquidity cycle.”

Source: Mister Crypto

Ether ETFs stabilize as XRP ETFs extend inflow streak

According to SoSoValue, spot Ether (ETH) $2,981 ETFs halted a four-day outflow trend on Tuesday, bringing in $67.8 million in net inflows. The inflow was a change from the previous four sessions, when spot Ether ETFs lost more than $196 million in net outflows. The worst loss in a single day happened on December 23, when funds lost around $95.5 million.