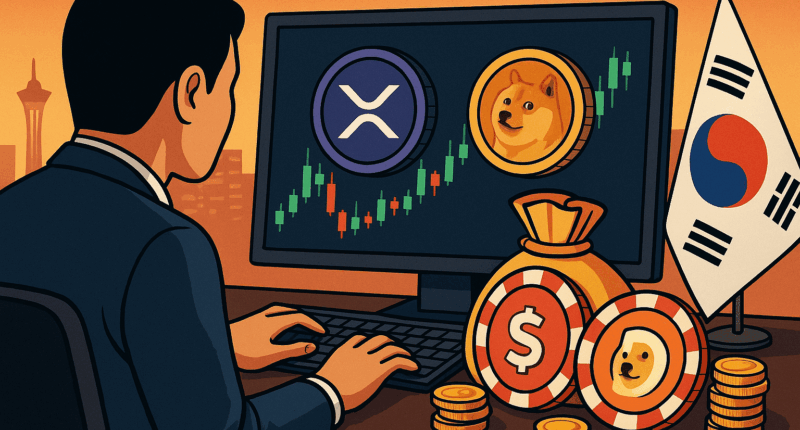

Retail investors in South Korea are driving a surge in altcoin trading, with XRP and Dogecoin volumes surpassing Bitcoin and Ether amid easing U.S.-China trade tensions and revived appetite for risk.

South Korea’s crypto markets are witnessing a renewed frenzy of speculative trading, with XRP and Dogecoin (DOGE) surging to the forefront. Over the past 24 hours, trading volumes for both tokens on Korean exchanges—particularly UpBit—have eclipsed those for Bitcoin (BTC) and Ether (ETH), reflecting a sharp pivot toward higher-risk assets.

Data shows 24-hour trading volumes for XRP/KRW and DOGE/KRW each topping $250 million, compared to under $150 million for BTC and ETH pairs.

Both XRP and DOGE have posted weekly gains exceeding 15%, outperforming Bitcoin’s 10% rise. Ether led the rally with a nearly 40% surge—its strongest weekly performance since 2021. Risk assets have recovered sharply to levels that are now challenging even the most ardent bears,” said Augustine Fan, head of insights at crypto options platform SignalPlus. The pain trade remains to be higher prices until more macro bears throw in the towel.”

Short squeeze and trade deal fuel momentum

Much of the rally has been attributed to a $1 billion short squeeze last week, which triggered forced liquidations of overleveraged bearish positions. Fan described it as a classic market short-squeeze against an exceptionally one-sided market, noting the lack of evidence for large ETH ETF inflows—suggesting the move was driven by speculative positioning rather than institutional flows.

Adding to the bullish sentiment, U.S. and Chinese officials announced plans to reduce tariffs from 145% to 30% for 90 days, marking a significant de-escalation in the months-long trade standoff. The easing of trade tensions has buoyed risk assets across global markets, from equities to digital currencies.

Investors are less apprehensive about crypto as U.S.-China trade talks find resolution and rate cuts appear more likely, said Jeff Mei, COO of BTSE.

Broader outlook: Altcoin-led risk rally continues

The current market structure points to altcoins leading the charge in this leg of the crypto rally. While institutional ETF flows and central bank guidance expected in June remain on watch, near-term momentum appears firmly in the hands of speculative traders.

With dovish Federal Reserve signals and reduced geopolitical risk, the path appears clear—at least for now—for further upside in the crypto markets.