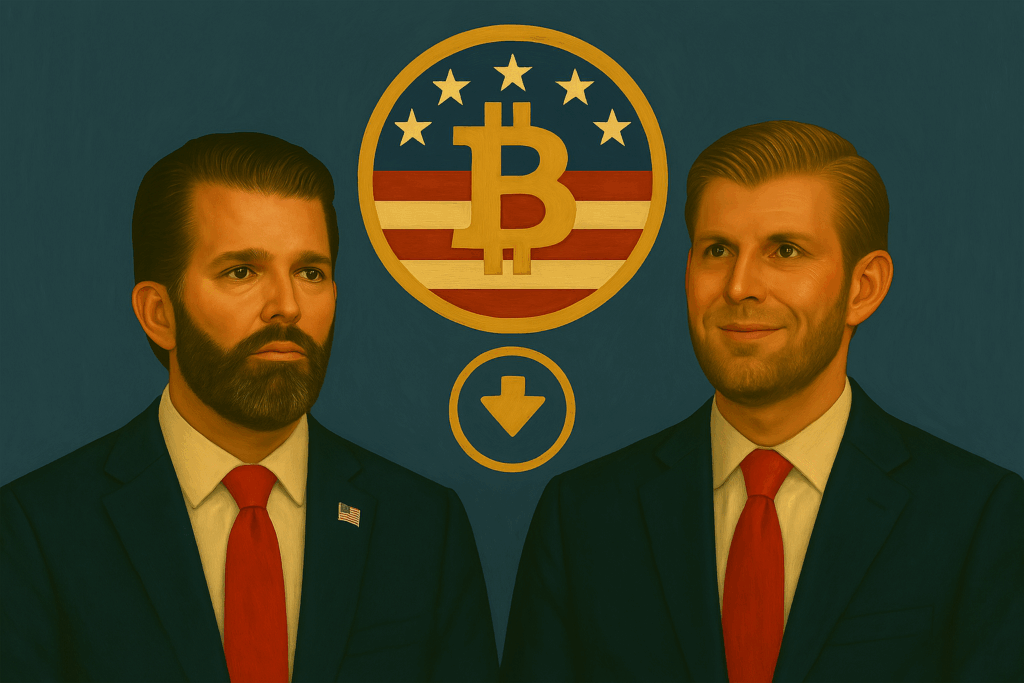

President Donald Trump’s two eldest sons, Eric Trump and Donald Trump Jr have quietly amassed 215 BTC worth over $23 million since April, via their mining firm, American Bitcoin, formally known as ABTC. The company has made this public through an SEC filing as it prepared to go public after its merger with Gryphon Digital Mining in May.

The filing states—Bitcoin accumulation as one of the business objectives for ABTC, which it will pursue through a ‘levered strategy’ combining Bitcoin mining and a disciplined Bitcoin reserve expansion. Its proposal for a 3-layered strategy includes: Building the engine, ie, to produce Bitcoin below market cost. It will achieve this by deploying capital into the physical infrastructure by direct Bitcoin generation.

The company says that it has over 60,000 Bitcoin miners with a cumulative hashrate of 10.17 EH/s and a weighted average fleet efficiency of 21.2 J/TH. With this in place, ABTC says that Bitcoin mining will serve as the base for its Bitcoin accumulation, however not an end in itself. Through its Layer 2 strategy, it plans to transform its Bitcoin production into long-term Bitcoin ownership. Moreover, its layer 3 initiatives will be evaluated against its fundamental objective of maximizing Bitcoin ownership per share.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

As more companies queue up to create a Bitcoin treasury reserve, ABTC may have an advantage, not only does it have the Trump family name, but it also is making the most of the suitable market sentiment surrounding Bitcoin, as the price of the cryptocurrency is on a tear. The fact that American Bitcoin has managed to accumulate 215 BTC in such a short span shows that it is committed to building a strong financial reserve, joining the likes of Strategy and Metaplanet.