Cryptocurrency ATMs, the machines that can instant convert fiat to crypto via cash or cards, are still viewed with some degree of suspicion and uncertainty. While crypto ATM players believe that the machines are crucial for the integration of digital assets into everyday uses, critics argue that these machines pose serious scam threats to the ecosystem.

The United States leads the world in the number of crypto ATMs accounting for majority installations globally, data by Statista shows. In this article, we will explore the steps to follow and precautions to take – while interacting with these kiosks.

What is a Crypto ATM?

A crypto ATM is a physical kiosk that lets individuals buy or sell cryptocurrencies using cash or debit cards. These machines are different from traditional ATMs as they do not link to a bank account. They link straight to the blockchain and your crypto wallet.

Many crypto ATMs mainly support Bitcoin, and an increasing number of newer models also accept Ethereum, Litecoin, USDT, and several other well-known assets. Some machines are built for one-way transactions (buy only), while others provide two-way functionality, allowing users to sell crypto and withdraw cash.

Here’s how crypto ATMs work

Cryptocurrency ATMs link blockchain networks with consumers. The device sends cryptocurrency from its reserve or a liquidity source directly to your wallet address once you insert cash or card and finalize a purchase.

The ATM calculates the exchange rate, applies transaction fees, and seamlessly sends the transaction to the blockchain in the background. The cryptocurrency could appear in your wallet within minutes or might take a bit longer to confirm, depending on the network’s activity.

How to use a crypto ATM: Complete guide

Using a cryptocurrency ATM is simple and straightforward, even for those new to it. Here are steps that could be helpful.

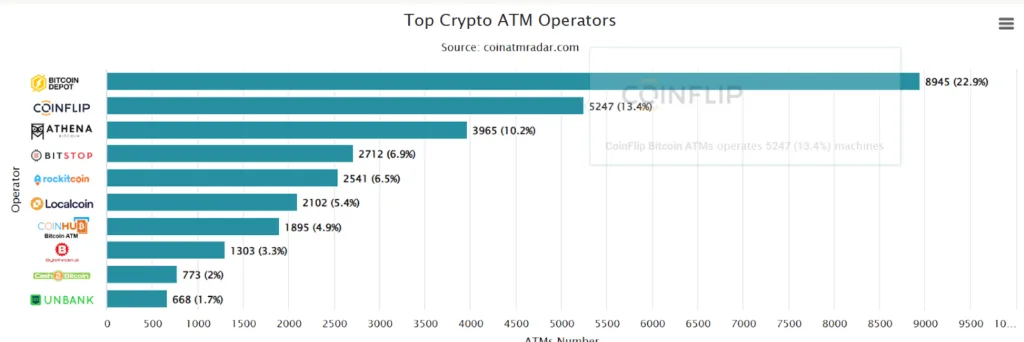

Choosing a crypto ATM: Only a handful of crypto ATM manufacturers are genuinely operating in the space. As per CoinATMRadar – Bitcoin Depot, Coinflip, and Athena are mammoth crypto ATM players. While picking an ATM to engage with, it is advisable to check the genuinity of the manufacturer.

Source: CoinATMRadar

How to locate one: Online ATM locators are easy to find online – much like food joints and petrol pumps.

Check for compatibility: Once you find a crypto ATM machine, check if the machine supports the assets you want to exchange for fiat or withdraw. The machine operator’s official website will have a list of tokens its ATMs are compatible with. While online ATM locators could also give information on compatible machines in the vicinity – it is always safer to rely on the information on official websites of the machine manufacturers.

Sign into your crypto wallet: To facilitate a transaction between your wallet and a crypto ATM, the wallet will need to generate a QR code for the verification of the transaction.

Choose your coin: Select the coin that you wish to purchase. Scan the QR code on your wallet, instructing the ATM on where to send your crypto. Feed the machine with cash to purchase tokens via the machine – which would then need to be transferred to your wallet through the QR code.

Buy Crypto: Before confirming your purchase, the machine will show the final exchange rate and fees. Once that is confirmed, you can go ahead with paying through cash or card.

Wait for confirmation: Once the transaction is complete, it could upto an hour for you to receive your crypto. Keep the receipt safe incase you need to monitor your translation or fix any problems.

Potential risks and challenges associated with crypto ATMs

Even though crypto ATMs are convenient, they do pose some significant challenges.

Exorbitant costs of exchange rates and fees typically ranging between five percent and 20 percent.

- Fraud and scams, especially targeting the new users

- Trade-offs with privacy because many ATMs now demand ID verification

- Limited assistance since customer support can be unavailable or extremely slow

- Most of the ATMs support limited cryptocurrencies

Due to these concerns, cryptocurrency ATMs being viewed as more uncertain or less efficient compared to online platforms would not be entirely debatable.

Best ways to safeguard yourself when using crypto ATMs

Treading cautiously while using crypto ATMs is strongly suggested to regular as well as first time users. Following are some precautions that can be taken.

If it is your first time using a crypto ATM, start with converting small amounts into crypto. It is crucial that you verify your wallet address independently before confirming the transaction to avoid losing funds due to the wrong transaction.

In case you are being guided over the phone, take your time with every decision and avoid haste. Avoid engaging with strangers as they could be scammers posing as insurance providers, government officials, or financial advisors.

Engage with crypto ATMS only in secure and trusted locations and never share your wallet keys and recovery phases.

Being cautious and informed significantly reduces the chances of costly mistakes.

Recently, countries like New Zealand and the U.K. among others, have tightened compliance regulations around crypto ATMs owing to rising cases of scams and frauds involving these machines. In June this year, Australia enforced a deposit and withdrawal limit of AUD 5,000 (roughly $3,271) on transactions processed via crypto ATMs. New Zealand has also banned crypto ATMs in an attempt to combat money laundering.

Despite setbacks, the network of crypto ATMs has shown growth in Canada, Spain, Australia, and Germany, data from various researches claims.