Why crypto capital gains tax matters

Cryptocurrency has transitioned from a niche experiment to a popular investment asset, which brings with it tax responsibilities. The tax on capital gains from cryptocurrencies has emerged as a critical concern for investors in the current landscape. Similar to stocks and real estate, selling or trading crypto could result in a taxable event each time. Grasping how this operates can help you save money and ensure compliance.

How does Crypto tax work?

The primary inquiry that many investors pose is straightforward: how does taxation on cryptocurrency function? The response, although based on the same fundamentals as conventional investing, possesses unique complexities specific to digital assets. In many areas, including the United States, cryptocurrency is categorized as property rather than currency. This indicates that any sale, exchange, or use of cryptocurrency to buy goods and services could trigger a taxable event.

Imagine an investor purchasing Ethereum for two thousand dollars and later selling it when the price increases to three thousand dollars. Even if Ethereum was utilized to purchase a laptop instead of being exchanged for fiat, the one-thousand-dollar profit is considered taxable income. Consequently, each transaction must be meticulously documented, ensuring that both the initial cost basis and the fair market value at the time of disposal are recorded. In the absence of these documents, investors may end up paying excessive taxes or, even more concerning, inaccurately reporting their income.

Crypto taxation extends beyond just sales. Activities like obtaining tokens via staking, mining, or airdrops could be regarded as regular income upon receipt, and any later sale would activate capital gains tax on cryptocurrency. This two-tiered system renders tracking and reporting particularly crucial for those engaging in anything beyond straightforward buy-and-hold approaches.

Capital gains on Bitcoin and other assets

Although Bitcoin is in the limelight, the capital gains derived from Bitcoin are taxed similarly to the gains from other cryptocurrencies. No matter if you’re trading Ethereum, Solana, or lesser-known altcoins, the core concept stays consistent: the difference between the purchase and sale price establishes your taxable gain or loss.

The rapid changes in cryptocurrency markets create another obstacle. A trader might conduct numerous transactions in a single day, resulting in a sequence of brief gains and losses. Conversely, a long-term investor who has possessed Bitcoin for many years may face a considerably different tax scenario when they opt to sell. In any circumstance, regulators expect accurate reporting, and noncompliance could lead to fines, penalties, or potential legal consequences.

Understanding capital gains and losses

To effectively maneuver the system, one needs to comprehend capital gains and losses as a whole. A capital gain occurs when the selling price of an asset exceeds the acquisition cost. A capital loss happens when the reverse is accurate. Both are equally significant for tax purposes.

If you made ten thousand dollars from one cryptocurrency trade but lost seven thousand on another, you will be taxed only on the net amount of three thousand. In the United States, investors are permitted to offset up to three thousand dollars of net capital losses against regular income annually. If losses surpass this threshold, the excess can be carried forward indefinitely to counterbalance gains in subsequent years.

This guideline holds significant importance for cryptocurrency investors. The industry is well-known for its unpredictability, and downturns frequently result in significant losses. Strategic tax-loss harvesting liquidating underperforming assets to recognize the loss and counterbalance other profits has become a popular tactic among astute investors.

Short-term vs long-term

The differentiation between short-term and long-term investments is arguably the most crucial tax factor. The short-term capital gains tax on cryptocurrency is applicable to assets kept for under twelve months. These profits are taxed at the individual’s regular income tax rate, which in the United States can reach up to thirty-seven percent. The tax on long-term capital gains for crypto is applicable to assets owned for more than a year. These gains are subject to favorable tax rates, usually ranging from zero to twenty percent based on income.

This variation can result in thousands of dollars in tax obligations. Selling Bitcoin after eleven months could incur a thirty-seven percent tax rate on the gain, but holding it for just one more month significantly lowers that rate. For numerous investors, patience is not just a trait of character but also an essential requirement for finances.

International perspectives

The global landscape for crypto taxation is uneven. In Germany, holding crypto for more than a year exempts it from taxation, making it one of the most favorable jurisdictions. The United Kingdom and Canada treat crypto gains much like stocks, applying standard capital gains tax rules. The United States uses the short-term and long-term framework. Meanwhile, the UAE has attracted entrepreneurs by imposing no capital gains tax at all.

These distinctions are incredibly significant for overseas investors and expatriates. Residency, domicile, and even dual nationality can affect which tax regulations are applicable. The growing globalization of the crypto sector requires many investors to manage multiple regulatory environments, often at the same time.

The future of Crypto taxation

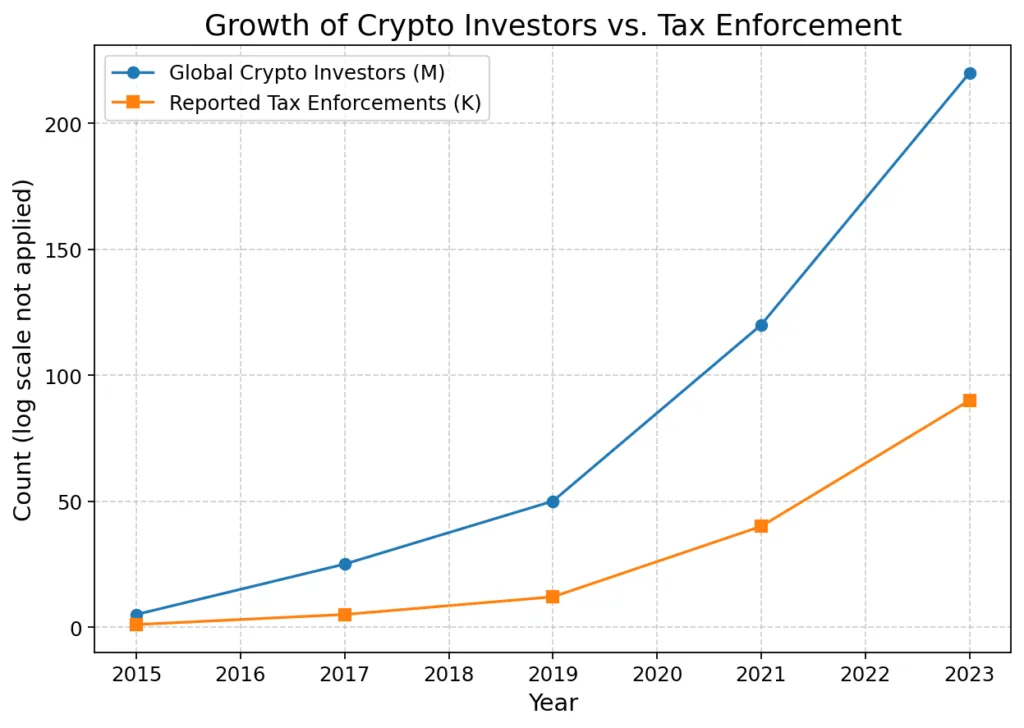

The development of crypto capital gains tax will be influenced by regulation and advancements. Governments are currently enforcing more rigorous reporting from exchanges, complicating the process of underreporting. In the United States, exchanges are set to issue standardized 1099-DA forms soon, while other regions are creating comparable reporting systems. Simultaneously, lawmakers are contending with how to regulate new practices such as staking, yield farming, and decentralized finance.

Industry associations are advocating for transparency and equity, contending that obsolete tax regulations must not hinder innovation. Some foresee universal standards, while others anticipate ongoing fragmentation as nations strive to lure crypto firms with advantageous regulations. For investors, the takeaway is evident: adhering to tax regulations will increasingly be crucial in the future.

How to avoid capital gains tax on crypto?

It is usually not feasible to entirely eliminate capital gains tax, but there are strategies to lessen the liability. Maintaining assets for more than a year reduces tax rates in various regions. Utilizing tax-advantaged accounts (where permitted), balancing gains with losses, and moving to crypto-friendly areas can further lower obligations.

What is the capital gains tax on crypto?

Cryptocurrency is generally taxed in a manner similar to that of property or stocks. When you sell, exchange, or use crypto, the earnings are taxed as capital gains. Short-term profits (within one year) are taxed at regular income rates, whereas long-term profits benefit from lower rates. Particular percentages differ between jurisdictions.

Why are capital losses limited to $3,000?

In the U.S., taxpayers can use capital losses to counterbalance unlimited capital gains, but only $3,000 annually can reduce ordinary income such as wages. This limit stops investors from significantly cutting taxable income through substantial losses. Unused losses are applied to subsequent years.