The premium puzzle

Investors seeking crypto exposure through public markets encounter a distinct dilemma: the prices of crypto ETFs or trusts frequently differ considerably from the net asset value (NAV) of the actual asset. This difference appears as premiums when shares are priced over NAV, or as discounts when they are priced under. These gaps are not merely temporary trading anomalies; they indicate a mix of market sentiment, structural inefficiencies, liquidity limitations, and regulatory constraints.

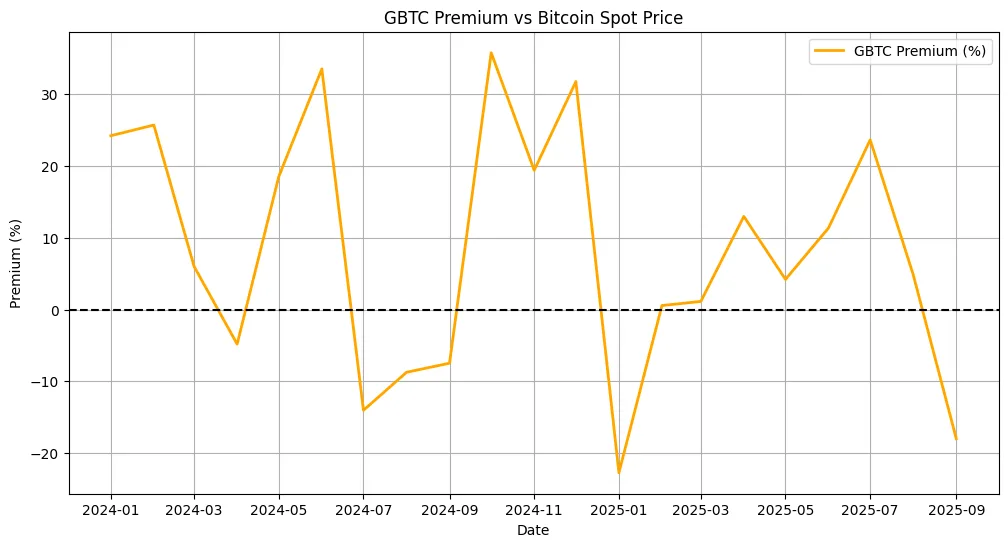

Consider Grayscale’s Bitcoin Trust (GBTC) as a key illustration. At various times, GBTC was priced at a double-digit premium over Bitcoin’s spot price, indicating strong retail interest in regulated entry. However, at different times, it fell to a considerable discount, indicating selling pressure and structural constraints such as the absence of a redemption mechanism. For investors, grasping these dynamics is essential. Exposure to public market crypto isn’t just about how prices move together; it’s about understanding the signals hidden in premiums, discounts, and trading behaviors.

The NAV lens

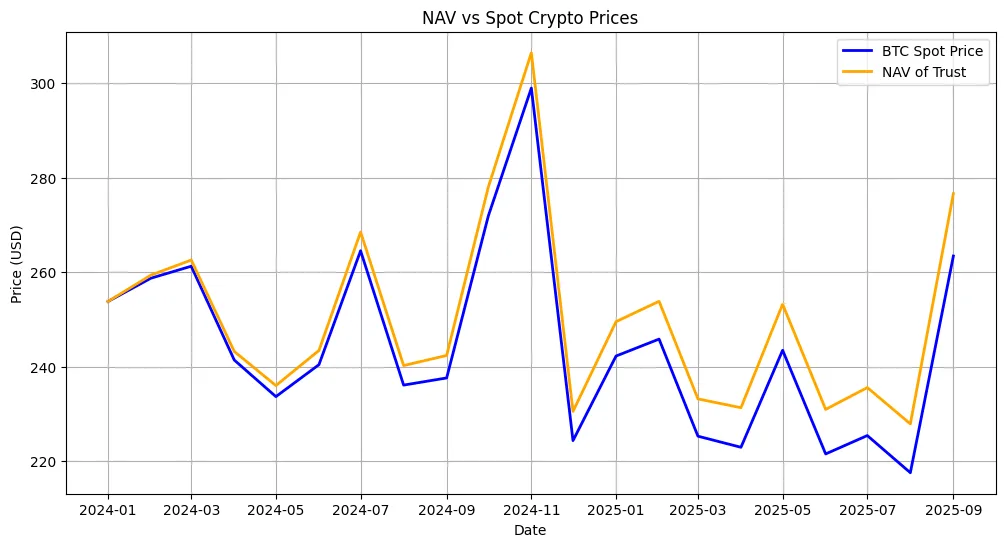

Net Asset Value (NAV) indicates the value per share of a fund’s foundational crypto assets. Purchasing Bitcoin directly indicates the market price, whereas NAV considers operational expenses, custody costs, lending revenue, and various modifications. Eventually, these elements can result in a significant gap between NAV and market price. For instance, certain funds offer Bitcoin loans to generate interest, gradually boosting NAV in addition to the spot changes. Alternative vehicles might consist of derivatives, staking incentives, or management charges, all of which impact the effective NAV.

Monitoring NAV in relation to market price is crucial for strategic investors. When shares are traded well above NAV, investors are essentially paying extra for emotional factors and limited availability instead of the actual crypto value. In contrast, a discount might suggest selling pressure, low liquidity, or expectations of structural shifts. Institutions frequently track NAV on a daily basis to determine whether to enter, exit, or conduct arbitrage, a process that can yield consistent alpha when executed properly.

Premiums & discounts: Opportunity or trap?

Premiums and discounts in public crypto vehicles are not just statistical curiosities; they are strategic signals. A premium implies that demand is outpacing the fund’s ability to issue shares, whereas a discount may suggest selling pressure, illiquidity, or redemption restrictions.

While arbitrage should theoretically bring prices closer to NAV, crypto’s regulatory landscape often prevents perfect alignment. For example, GBTC historically allowed purchases but restricted direct redemptions, meaning that during periods of stress, discounts could persist for months. Investors who understood this mechanism profited by either waiting for a discount to normalize or by timing secondary market trades strategically.

Similarly, when ETHE, the Ethereum trust, traded at a discount, savvy investors monitored the premium/discount cycles to anticipate corrections. Recognizing these structural inefficiencies is crucial; premiums can act as a cautionary sign, and discounts as a potential opportunity but only if investors account for regulatory and structural constraints.

The DAT flywheel effect

The DAT Demand, Access, Timing flywheel illustrates ongoing patterns in public cryptocurrency markets. Growing demand for regulated exposure results in the issuance of new shares or ETFs, broadening access for retail and institutional investors. Timing is crucial: those who enter early usually enjoy discounted NAV exposure, whereas newcomers might pay a higher price as scarcity increases demand.

The flywheel is self-perpetuating: as accessibility enhances, liquidity increases, premiums narrow, and market price aligns more closely with NAV. The cycle can be seen during ETF approvals, as increased media attention boosts demand, causing funds to release more shares, which normalizes premiums. Investors who grasp the DAT flywheel can foresee market shifts and strategically align themselves.

Implications for investors’ strategies

Maneuvering through public cryptocurrency markets demands both understanding and perseverance. For investors looking for regulated access without managing private keys, grasping NAV, premiums, and the DAT flywheel is crucial. Arbitrage chances are available, yet they are typically reachable only by institutions that have creation/redemption functionalities. Retail investors can continue to position strategically by monitoring historical premium/discount patterns, NAV influences, and events like ETF approvals or regulatory updates.

Timing is essential. Individuals expecting spikes in demand, whether due to retail adoption or institutional investments, can invest before premiums increase, gaining effective NAV exposure at a lower price. On the other hand, investors that overlook structural details may face losses even in thriving crypto markets. The integration of market monitoring, structural comprehension, and timing establishes the basis of a systematic method for engaging with public market crypto investments.